Storefront windows for commercial buildings typically cost $50–150 per square foot installed, with complete single‑unit systems ranging from $800–3,500 depending on material, glass specifications, and performance requirements. Multi‑unit projects benefit from volume discounts of 20–40%, with very large or standardized developments sometimes reaching 45% for factory‑direct orders. This comprehensive guide breaks down storefront window costs by material type, glass performance specifications, acoustic requirements, and project scale. Whether you’re planning a single retail storefront or a multi‑location commercial rollout, understanding these cost factors helps you budget accurately and select the right system for your application.

Storefront Window Cost Breakdown

Storefront window pricing varies significantly based on system type, materials, glass specifications, and project volume. Understanding these cost components helps developers and contractors create accurate budgets for commercial projects.

Cost by Pricing Method

| Pricing Method | Cost Range | Best Used For | What’s Included |

|---|---|---|---|

| Per Square Foot | $50–150/sq ft | Large projects, budgeting | Material + standard installation |

| Per Unit (Standard) | $800–1,800/unit | Single storefronts | 6’×8′ frame + single glazing |

| Per Unit (Custom) | $1,500–3,500/unit | Architectural projects | Custom sizing + enhanced specs |

| Complete System | $5,000–25,000+ | Full storefronts |

- Note: Installed costs include both materials and labor. Material‑only pricing typically runs 50–60% of installed cost.

Cost by Material Type

| Material | Cost Range (Installed) | Typical Applications | Lifespan |

|---|---|---|---|

| Aluminum (Standard) | $50–85/sq ft | Retail, restaurants, offices | 25–35 years |

| Aluminum (Thermal Break) | $75–120/sq ft | Climate‑controlled spaces | 30–40 years |

| Steel (Architectural) | $95–150/sq ft | High‑end retail, historic | 40–50 years |

| Frameless Glass | $110–180/sq ft | Ultra‑modern retail, showrooms | 20–30 years |

- Aluminum storefront systems represent roughly 70–80% of commercial installations due to their balance of durability, cost‑effectiveness, and design flexibility.

Cost by Project Size (Volume Discounts)

| Project Scale | Units/Openings | Cost per Unit | Total Discount | Typical Projects |

|---|---|---|---|---|

| Single Storefront | 1–2 units | $1,500–2,200 | Baseline | Individual retail, restaurant |

| Small Commercial | 3–5 units | $1,200–1,800 | 15–20% | Strip mall, small building |

| Mid‑Size Project | 6–15 units | $950–1,500 | 25–35% | Multi‑tenant retail, hotel |

| Large Development | 20+ units | $800–1,300 | 35–45% | Shopping centers, franchises |

- Volume pricing applies when ordering multiple identical or similar units within the same project timeline. Factory‑direct sourcing eliminates distributor markup (typically 40–60%), providing additional savings on large commercial projects.

Complete Project Budget Considerations

Beyond material and installation costs, commercial storefront projects should account for building permits ($200–1,500 depending on jurisdiction), structural modifications if openings require resizing ($500–3,000), and disposal of existing materials ($300–800). Professional developers typically budget 15–20% contingency for unforeseen site conditions or specification changes.

Material Selection Decision Matrix

| Building Type | Primary Material | Alternative | Key Consideration |

|---|---|---|---|

| Retail (Budget) | Standard aluminum | Thermal break aluminum | Balance cost with HVAC efficiency |

| Restaurant | Thermal break aluminum | High‑performance aluminum | Energy costs over 10+ years |

| Office/Professional | Thermal break aluminum | Steel (if architectural) | Energy codes, corporate standards |

| High‑End Retail | Steel or frameless | High‑performance aluminum | Brand |

- Selecting the right material for storefront windows balances aesthetics, performance requirements, budget constraints, and building type. Each material offers distinct advantages for different commercial applications.

Aluminum Storefront Systems

Standard Aluminum ($50–85/sq ft installed) dominates commercial storefront applications. The material provides excellent strength‑to‑weight ratio, corrosion resistance, and minimal maintenance requirements. Standard aluminum works well for:

- Strip mall retail with climate control

- Interior storefronts (mall spaces)

- Temperate climate installations

- Budget‑conscious projects prioritizing durability

Thermal Break Aluminum ($75–120/sq ft installed) incorporates insulating barriers between interior and exterior aluminum components, significantly improving energy efficiency. U‑factors typically improve from 0.60–0.70 (standard) to around 0.35–0.50 (thermal break). Specify thermal break systems for:

- Restaurants maintaining HVAC efficiency

- Office buildings with energy performance requirements

- Cold climate installations (heating zones 4–7)

- LEED or energy code compliance projects

High‑Performance Aluminum ($95–140/sq ft installed) adds structural reinforcement, enhanced weatherproofing, and superior thermal performance (U‑factor often 0.30–0.40). These systems suit:

- High‑wind coastal zones

- Large‑span openings (10+ feet wide)

- Occupied buildings requiring minimal air infiltration

- Premium retail demanding maximum transparency

Steel Storefront Systems

Architectural Steel ($95–150/sq ft installed) provides ultra‑narrow sightlines, exceptional strength, and distinctive aesthetics. Steel’s higher structural capacity allows larger glass spans with thinner frame profiles. Consider steel for:

- High‑end retail prioritizing visual impact

- Historic building renovations (matching existing profiles)

- Projects requiring custom colors/finishes

- Architects specifying narrow sightlines (<2 inches)

Steel requires proper finishing (galvanizing, powder coating) to prevent corrosion, particularly in humid or coastal environments. Maintenance costs typically run 15–25% higher than aluminum over a 20‑year lifespan.

Frameless Glass Systems

Structural Glazing ($110–180/sq ft installed) eliminates visible framing, creating seamless all‑glass facades. Tempered glass panels (typically 1/2″–3/4″ thick) connect via minimal hardware. Applications include:

- Luxury retail maximizing product visibility

- Showrooms emphasizing transparency

- Modern architectural statements

- Buildings with minimal structural depth for frames

Limitations: Frameless systems offer reduced thermal performance (U‑factor commonly 0.80–1.00), limited acoustic dampening, and require perfectly plumb structural openings. Installation complexity increases costs 30–40% versus framed systems.

Material Selection Decision Matrix

| Building Type | Primary Material | Alternative | Key Consideration |

|---|---|---|---|

| Retail (Budget) | Standard aluminum | Thermal break aluminum | Balance cost with HVAC efficiency |

| Restaurant | Thermal break aluminum | High-performance aluminum | Energy costs over 10+ years |

| Office/Professional | Thermal break aluminum | Steel (if architectural) | Energy codes, corporate standards |

| High-End Retail | Steel or frameless | High-performance aluminum | Brand image, visual impact |

| Historic Buildings | Steel (matching) | Custom aluminum | Matching existing profiles |

| Coastal/High-Wind | High-performance aluminum | Impact-rated aluminum | Code requirements, insurance |

Glass Specifications & Performance Requirements

Glass selection significantly impacts storefront window cost, energy performance, safety compliance, and long‑term operating expenses. Commercial projects must balance multiple performance criteria with budget constraints.

Safety Glass Requirements

Tempered Glass (add $8–15/sq ft to base cost) undergoes heat treatment creating surface compression. When broken, it fractures into small granular pieces rather than large shards. Building codes require tempered glass for:

- All glass within 18 inches of walking surfaces

- Glass in doors and adjacent sidelights

- Glass below 60 inches from floor level

- High‑traffic commercial applications

Laminated Glass (add $18–30/sq ft to base cost) bonds two glass layers with an interlayer film (typically PVB). When broken, glass adheres to the film rather than falling. Specify laminated glass for:

- Ground‑floor retail in high‑crime areas

- Forced‑entry resistance (meets ASTM F1233)

- Hurricane‑rated installations (combine with impact testing)

- Enhanced acoustic performance (see Acoustic section)

- UV protection for merchandise (blocks up to 99% UV)

Energy Efficiency Options

Single‑Pane Glass (baseline cost) provides minimal thermal insulation (U‑factor approximately 1.00–1.10). Acceptable for:

- Interior storefronts (climate‑controlled malls)

- Temperate climates with minimal heating/cooling loads

- Budget‑priority projects with exterior HVAC coverage

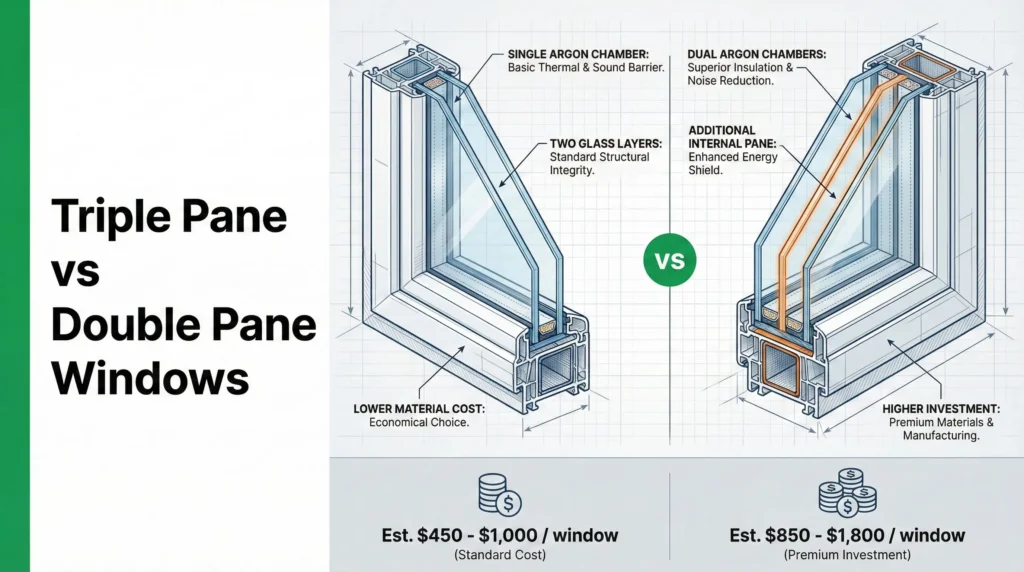

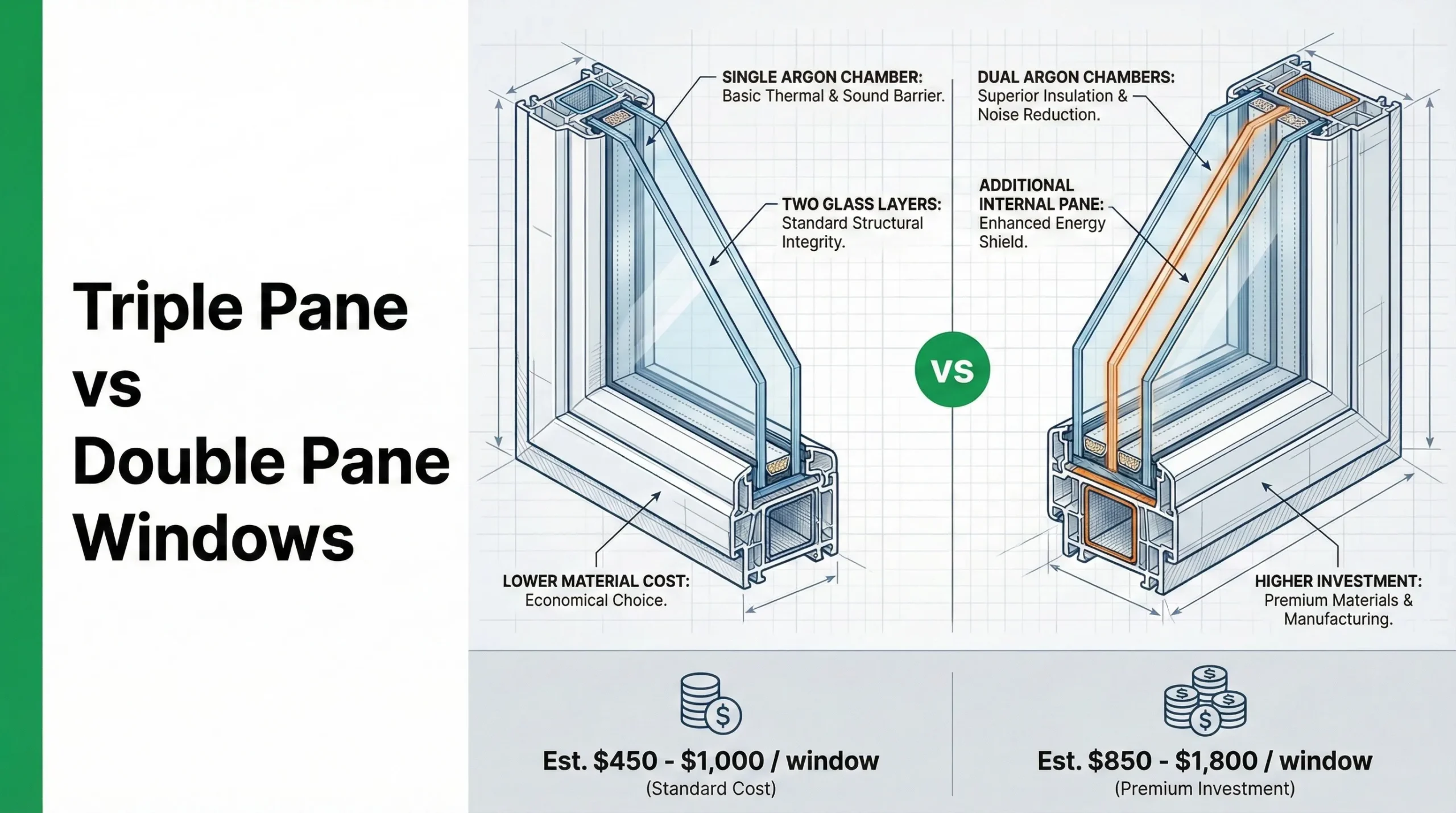

Insulated Glass Units (IGU) (add $25–45/sq ft) sandwich air or gas between two glass panes, dramatically improving thermal performance:

- Standard IGU (air‑filled): U‑factor about 0.45–0.55

- Low‑E coated IGU: U‑factor about 0.30–0.40

- Argon‑filled Low‑E: U‑factor about 0.25–0.35

IGU payback period typically runs 4–7 years in climate‑controlled buildings through reduced HVAC costs. Energy codes in most jurisdictions now mandate IGU for conditioned spaces.

Low‑E Coatings (add $8–15/sq ft to IGU cost) reflect infrared heat while transmitting visible light. Multiple Low‑E formulations optimize for different climates:

- High Solar Gain (northern climates): Allows winter heat gain, blocks summer heat

- Low Solar Gain (southern climates): Blocks heat year‑round

- Moderate Solar Gain (mixed climates): Balances seasonal needs

Glass Cost Comparison by Specification

| Glass Type | Base Cost (material) | Installed Cost | U-Factor | Best Application |

|---|---|---|---|---|

| Single Pane, Tempered | $18-25/sq ft | $50-70/sq ft | 1.00-1.10 | Interior, temperate climate |

| Single Pane, Laminated | $30-42/sq ft | $65-95/sq ft | 0.95-1.05 | Security, acoustic |

| IGU, Tempered | $40-55/sq ft | $80-115/sq ft | 0.45-0.55 | Standard commercial |

| IGU, Low-E, Tempered | $48-65/sq ft | $90-130/sq ft | 0.30-0.40 | Energy-efficient |

| IGU, Laminated, Low-E | $60-85/sq ft | $110-155/sq ft | 0.35-0.45 | High-performance |

Building Code & Climate Considerations

Energy Code Compliance: IECC 2021 mandates maximum U‑factors by climate zone for commercial fenestration, typically in these ranges:

- Zones 1–3 (warm): U‑factor ≤0.50

- Zones 4–5 (mixed): U‑factor ≤0.40

- Zones 6–8 (cold): U‑factor ≤0.35

Wind Load Requirements: Storefront glass must withstand design wind pressures per ASCE 7, with higher demands in coastal and high‑rise locations. Coastal and high‑rise buildings require structural calculations and potential glass thickness increases:

- Standard installations: 1/4″ glass often adequate

- Moderate exposure: 5/16″ or 3/8″ glass

- High‑wind zones: 1/2″ glass with reinforced frames

Impact Ratings: Hurricane‑prone regions (HVHZ) require impact‑resistant glazing meeting ASTM E1996 and local amendments. Miami‑Dade NOA and Florida Product Approval commonly add $35–65/sq ft to baseline costs for fully tested systems.

Local code amendments may be more stringent, so always confirm final requirements with your design professional and building department.

Acoustic Performance for Retail & Restaurant Storefront

Urban retail spaces, street‑facing restaurants, and hospitality venues increasingly specify acoustic performance in storefront systems. Exterior noise from traffic, pedestrians, and entertainment districts can significantly impact customer experience, making Sound Transmission Class (STC) ratings a critical specification beyond basic cost and energy factors.

When Acoustic Performance Matters

High‑Priority Acoustic Applications:

- Restaurants with outdoor dining: Street noise at 75–85 dB can make indoor conversation difficult without adequate glazing.

- Urban retail in entertainment districts: Late‑night bar/club noise penetrating storefronts affects daytime businesses.

- Hotels and boutique lodging: Ground‑floor lobby areas facing busy streets.

- Professional services: Law offices, financial services maintaining client privacy.

- Showrooms in high‑traffic areas: Automotive dealers, furniture stores near highways.

Regulatory Drivers: Some municipalities now mandate minimum STC ratings for new commercial construction in high‑noise zones. For example, New York City and several major metros recommend or require enhanced acoustic specifications near highways, rail lines, and major corridors, often targeting STC 35+ or better for sensitive spaces.

Understanding STC Ratings for Storefront

Sound Transmission Class (STC) measures how effectively a building partition reduces airborne sound transmission. Higher numbers indicate better sound blocking:

| STC Rating | Sound Reduction | Perception | Typical Storefront Type |

|---|---|---|---|

| STC 25-28 | Minimal | Normal conversation clearly heard | Single-pane, standard frames |

| STC 29-32 | Basic | Loud conversation audible | Standard aluminum + tempered glass |

| STC 33-37 | Moderate | Loud speech muffled, understandable | IGU with standard spacing |

| STC 38-42 | Enhanced | Loud speech heard but not understood | Laminated glass + IGU combinations |

| STC 43+ | Superior | Most sounds blocked except very loud | Specialized acoustic systems |

- Real‑World Impact: Upgrading from around STC 30 (basic storefront) to STC 38 (enhanced acoustic) can reduce perceived noise levels by roughly 40–50%, creating noticeably quieter interior environments even on busy urban streets.

Achieving Acoustic Performance in Storefront Systems

Material Strategies for Enhanced STC:

- Laminated Glass provides the most cost‑effective acoustic improvement. The PVB interlayer dampens vibration, disrupting sound wave transmission:

- Single‑pane laminated: STC 33–35 (vs STC 28 standard tempered)

- IGU with one laminated lite: STC 36–38

- IGU with both lites laminated: STC 39–42

- Dissimilar Glass Thickness: Using different glass thicknesses on each side of an IGU prevents sound wave resonance. For example, 1/4″ outer lite + 3/16″ inner lite can outperform two 1/4″ lites by 2–3 STC points.

- Increased Airspace in IGU: Wider spacing between glass lites improves low‑frequency sound blocking:

- 1/2″ airspace (standard IGU): Baseline acoustic

- 1″ airspace: about +2–3 STC improvement

- 2″ airspace: about +4–5 STC improvement

- Frame System Sealing: Even high-performance glass fails if frames leak sound. Acoustic storefronts require:

- Continuous weatherstripping (no gaps at corners)

- Compression seals rather than sliding contact

- Sealed frame joints with acoustic sealant

- Proper installation maintaining seal integrity

Acoustic Storefront Cost Comparison

| System Specification | Installed Cost (vs Standard) | STC Rating | Cost Premium | Best Applications |

|---|---|---|---|---|

| Standard Aluminum + IGU | $80-115/sq ft (baseline) | 32-34 | Baseline | Low-noise environments |

| Aluminum + Laminated IGU (1 lite) | $95-135/sq ft | 36-38 | +15-20% | Moderate urban noise |

| Aluminum + Dual Laminated IGU | $115-160/sq ft | 39-42 | +35-45% | High urban noise, entertainment districts |

| Thermal Break + Dual Laminated + Wide Airspace | $140-190/sq ft | 42-45 | +60-75% | Premium applications, extreme noise |

Cost‑Benefit Analysis: For a typical 200 sq ft storefront:

- Standard system: $16,000–23,000 (STC 32–34)

- Enhanced acoustic: $23,000–32,000 (STC 38–42)

- Investment: $7,000–9,000 additional upfront

Restaurants and retail spaces often report acoustic upgrades paying back through increased customer dwell time and satisfaction, though this remains difficult to quantify precisely. For hospitality and professional services, acoustic performance directly impacts core business function.

Acoustic Design Recommendations by Application

| Business Type | Minimum STC Target | Recommended System | Priority Level |

|---|---|---|---|

| Retail (Low-Traffic Area) | 28-32 | Standard IGU | Low priority |

| Retail (Urban Core) | 33-36 | Single laminated IGU | Medium |

| Restaurant (Suburban) | 32-35 | Standard or single laminated IGU | Medium |

| Restaurant (Urban/Entertainment) | 38-42 | Dual laminated IGU | High priority |

| Hotel Lobby | 36-40 | Single or dual laminated IGU | High priority |

| Professional Office | 38-42 | Dual laminated IGU | High priority |

| Showroom (Near Highway) | 35-38 | Single laminated IGU, wider airspace | Medium-High |

- Installation Note: Acoustic performance depends on complete system installation including proper sealing, structural sound breaks, and addressing flanking paths through walls and structural elements. Specify acoustic storefront as a complete system, not just glass specification.

Installation Costs & Timeline

Installation labor often represents 40–50% of total storefront window project costs. Understanding the factors that drive installation complexity helps in accurate budgeting and realistic timeline planning.

Installation Cost Variables

Building Access & Height: Ground‑floor storefronts with direct exterior access cost roughly $45–65/sq ft for labor. Multi‑story installations requiring lifts or scaffolding increase labor to about $65–95/sq ft. Building height determines equipment needs:

- Ground floor (direct access): Standard labor rates

- 2–3 stories: Small lift equipment (+15–25% labor)

- 4+ stories: Scaffolding or crane access (+30–50% labor)

Existing Condition & Removal: New construction openings with prepared rough openings cost less than replacement projects requiring demolition. Removal complexity adds:

- Standard aluminum removal: $15–25/sq ft

- Deteriorated frames requiring structural repair: $25–45/sq ft

- Occupied buildings (dust control, protection): Additional $800–1,500 per project

Structural Modifications: Changing opening dimensions requires structural work beyond standard installation:

- Minor trim adjustments (<2 inches): $200–500 per opening

- Significant resizing: $800–2,000 per opening

- Structural header/lintel work: $1,500–4,000 per opening

Regional Labor Rates: Installation costs vary by geographic market:

- Tier 1 cities (NYC, SF, LA): $75–95/sq ft labor

- Tier 2 cities (Atlanta, Denver, Seattle): $55–75/sq ft labor

- Suburban/rural markets: $45–65/sq ft labor

Project Timeline by Scale

| Project Size | Preparation | Installation Duration | Lead Time (Material) | Total Timeline |

|---|---|---|---|---|

| 1-2 Storefronts | 1-2 days | 3-5 days | 8-10 weeks | 10-12 weeks |

| 3-5 Storefronts | 2-3 days | 5-8 days | 8-12 weeks | 11-14 weeks |

| 6-10 Storefronts | 3-5 days | 10-15 days | 10-14 weeks | 13-17 weeks |

| 15+ Storefronts (Phased) | 5-10 days | 20-30 days | 12-16 weeks | 16-22 weeks |

Critical Timeline Factors:

- Custom sizing adds 2–4 weeks to lead time

- Non‑standard finishes (custom colors): +2–3 weeks

- Impact‑rated or specialized testing: +3–6 weeks

- Overseas manufacturing (Asia to Americas): 8–12 weeks sea freight

When Installation Costs More

Occupied Buildings: Retail or restaurant spaces remaining open during installation require after‑hours work, dust containment, and temporary barriers. Expect 25–40% labor premium for occupied space installations maintaining business operations.

Historic or Landmark Buildings: Preservation requirements, specialized approval processes, and matching existing profiles increase design and installation complexity. Budget 30–60% premium over standard commercial installations.

Complex Glazing Systems: Frameless glass systems, structural glazing, and large‑format panels (>100 sq ft single lites) require specialized installation expertise and equipment. Installation premiums run 30–50% versus standard framed systems.

New Installation vs Replacement: Cost Comparison

Determining whether to replace existing storefront systems or perform full renovation depends on current condition, building requirements, and budget constraints. Each approach offers distinct cost profiles and outcomes.

Replacement Projects (Existing Openings)

Scope: Remove existing storefront and install new system in prepared openings without structural modifications.

Cost Range: $80–150/sq ft installed (material + labor + removal).

When Replacement Makes Sense:

- Existing frames deteriorated but openings structurally sound

- Upgrading performance (thermal, acoustic) without major aesthetic changes

- Maintaining building operations during work

- Budget‑conscious projects with functional existing openings

Replacement Cost Breakdown (typical 150 sq ft storefront):

- New material: $6,000–9,000

- Removal & disposal: $2,000–3,500

- Installation labor: $4,500–7,000

- Permits & fees: $300–800

- Total: $12,800–20,300

Full Renovation (Structural Changes)

Scope: Modify opening dimensions, upgrade structural support, potentially relocate doors or add glass area.

Cost Range: $120–250/sq ft (including structural work).

When Renovation Is Justified:

- Maximizing glass area for modern retail aesthetics

- Improving building envelope performance comprehensively

- Addressing code deficiencies (outdated fire ratings, accessibility)

- Repositioning entry locations for better traffic flow

- Increasing glass for merchandise visibility

Full Renovation Cost Breakdown (same 150 sq ft, enlarged opening):

- New material: $7,500–12,000

- Structural modifications: $4,000–8,000

- Removal & disposal: $2,500–4,000

- Installation labor: $6,000–9,500

- Engineering & permits: $1,200–2,500

- Total: $21,200–36,000

Decision Matrix

| Current Condition | Recommended Approach | Cost Impact | Timeline |

|---|---|---|---|

| Frames sound, glass damaged | Glass-only replacement | 30-40% of full replacement | 1-2 weeks |

| Frames deteriorated, openings good | Complete replacement | Baseline cost | 3-5 weeks |

| Poor thermal/acoustic performance | Replacement with upgraded specs | +20-35% vs standard | 3-5 weeks |

| Functional but outdated aesthetics | Replacement (cost-effective) vs renovation (maximum impact) | Compare ROI | 3-8 weeks |

| Code deficiencies or structural issues | Full renovation (required) | +50-100% vs replacement | 6-12 weeks |

| Repositioning/resizing openings | Full renovation | +60-120% vs replacement | 8-14 weeks |

ROI Considerations for Retail & Restaurant Owners

Energy Performance Upgrades: Replacing single‑pane storefronts with thermal break + Low‑E IGU systems can reduce HVAC consumption by roughly 15–25% in conditioned spaces. For a typical 200 sq ft storefront, that often translates to $400–800/year in energy savings, with a payback period in the 8–15 year range depending on climate and utility rates.

Aesthetic Renovation Impact: Many commercial real estate and retail case studies suggest updated storefronts can increase property values by about 5–12% in competitive retail districts, while also improving foot traffic and tenant appeal.

Acoustic Upgrades: Restaurants in high‑noise areas frequently report improved customer satisfaction and more comfortable dining environments following acoustic storefront upgrades, though exact financial return varies significantly by location and concept.

Ways to Reduce Storefront Window Costs

Strategic planning and informed material selection can significantly reduce storefront window project costs without compromising essential performance or longevity.

Volume and Timing Strategies

Multi‑Unit Projects: Ordering multiple identical or similar storefront systems within one project achieves manufacturer volume discounts:

- 3–5 units: 15–20% reduction per unit

- 6–10 units: 25–30% reduction

- 15+ units: 35–45% reduction

Franchises and retail chains planning multi‑location rollouts should consolidate orders when possible, even if installation occurs in phases. Manufacturers typically hold pricing for 90–180 days on confirmed volume orders.

Off‑Season Installation: Some glazing contractors offer 10–15% labor discounts during slower periods (typically late fall and winter in many markets, excluding urgent weather‑driven repairs). However, balance savings against potential weather delays in harsh climates.

Factory‑Direct Sourcing: Eliminating distributor intermediaries reduces costs 40–60% on material pricing. Manufacturers like Hotian supply directly to developers and general contractors, providing:

- Eliminated distributor markup (often 40–60%)

- Customization without typical premium pricing

- Direct engineering support

- Streamlined communication reducing delays and errors

For projects of 10+ units or $50,000+ material value, factory‑direct sourcing typically provides the single largest cost reduction opportunity.

Material and Specification Optimization

Standard Sizes: Custom‑sized storefront systems can increase costs 20–35% versus standard dimensions. Common standard sizes include:

- 6′ × 8′ single units

- 8′ × 10′ single units

- 4′ × 8′ sidelights

Design around standard sizing when site conditions allow, reserving custom sizing for architecturally critical locations.

Aluminum Over Steel: Unless architectural requirements or historic matching mandates steel, aluminum systems often cost 20–40% less while providing roughly 90% of steel’s functional performance for typical commercial applications.

Selective Performance Upgrades: Rather than specifying high‑performance glass and frames throughout, strategically upgrade only critical areas:

- Enhanced thermal performance on climate‑controlled spaces

- Acoustic‑rated glass on noise‑exposed facades only

- Impact‑rated systems only where code‑mandated

- Standard specifications on protected or low‑priority elevations

This targeted approach can reduce overall project costs 15–25% versus uniform high‑spec installations.

Value Engineering Without Compromise

Avoid False Economies: These “savings” typically backfire:

- ❌ Undersized frames: Premature failure, structural inadequacy

- ❌ Non‑compliant glass: Code violations, insurance issues, safety liability

- ❌ Inadequate weatherproofing: Water infiltration, interior damage exceeding initial savings

- ❌ Unqualified installers: Poor performance, costly repairs, voided warranties

- ✅ Standard finishes (mill, bronze, black) cost less than custom colors

- ✅ Tempered glass (where code allows) often costs $10–18/sq ft less than laminated

- ✅ Standard IGU airspace (1/2″) is adequate for most applications vs wider custom spacing

- ✅ Sourcing material and installation separately when you are managing general contractor responsibilities

Long‑Term Cost Considerations

Warranty Coverage: Manufacturer warranties vary from 5–20 years. Longer warranties typically correlate with better material quality and lower long‑term maintenance costs. Budget products with 5–7 year warranties often require replacement or significant repair within 12–15 years, negating initial savings.

Maintenance Requirements: Aluminum systems require minimal maintenance (annual cleaning, periodic weatherstripping replacement). Steel requires periodic recoating ($8–15/sq ft every 10–15 years). Factor maintenance costs over the expected building ownership period.

Energy Efficiency: Low‑E IGU systems cost $15–30/sq ft more than standard glass but can save roughly $2–4/sq ft/year in HVAC costs for conditioned spaces, depending on climate and usage. Break‑even often occurs in 6–10 years with continued savings throughout a 25–40 year system lifespan.

Hotian Storefront Projects & Factory‑Direct Advantage

Hotian manufactures commercial‑grade aluminum storefront systems for global projects, providing factory‑direct pricing and engineering support to developers, general contractors, and glazing contractors.

Factory‑Direct Commercial Model

Traditional storefront window supply chains include multiple markup layers:

Manufacturer → Regional Distributor (40–60% markup) → Local Dealer (20–30% markup) → End Customer

Hotian’s Direct Model eliminates distributor intermediaries:

Manufacturer → Direct to Developer/Contractor → End Customer

This reduces material costs 40–60% on equivalent specifications, making high‑performance systems accessible at traditional mid‑grade pricing.

Volume Project Capabilities

Minimum Order Quantities: Hotian accommodates projects from single storefronts to large‑scale developments:

- Small projects (1–5 units): Standard pricing, 10–12 week lead time

- Mid‑size projects (6–20 units): 15–25% volume discount

- Large projects (25+ units): 30–45% volume discount, dedicated project management

Custom Sizing: In-house engineering and fabrication enable custom dimensions without the premium pricing typical of distributor channels. Standard lead time applies to most custom sizing within reasonable parameters (up to about 12′ height and 20′ width single spans, depending on engineering).

Technical Support & Documentation

Engineering Services Included:

- Submittal package preparation (drawings, specifications, performance data)

- Structural calculations for wind load, deflection, thermal movement

- Installation details and waterproofing specifications

- Code compliance documentation (AAMA, NFRC, local amendments)

Certifications (project‑dependent):

- AAMA 501 testing (air infiltration, water penetration, structural performance)

- NFRC ratings (U‑factor, SHGC, VT) for energy code compliance

- Impact resistance testing (ASTM E1996, Miami‑Dade NOA) for hurricane zones

- CE marking for international projects

Project Examples

- Urban Retail Complex – Panama City, Panama (2024)

- Scope: 18 ground‑floor retail storefronts, mixed‑use development.

- System: Thermal break aluminum, Low‑E IGU, STC 36 acoustic rating.

- Openings: Mix of 6’×8′ and 8’×10′ units, custom 4’×8′ sidelights.

- Result: 38% cost reduction vs. local distributor quotes, 11‑week delivery.

Restaurant Chain Expansion – West Africa (2023–2024)

- Scope: 12 locations, 2–3 storefronts each (28 total units).

- System: Standard aluminum, laminated glass for security, bronze finish.

- Challenge: Multi‑country logistics, phased rollout over 8 months.

- Result: Consistent specifications across locations, volume pricing maintained through phased delivery.

Requesting Factory‑Direct Quotes →

Information Required for Accurate Estimation:

- Opening dimensions (width × height for each unit)

- Quantity and timeline (single phase or phased delivery)

- Glass specifications (tempered, laminated, IGU, Low‑E, acoustic requirements)

- Frame finish (mill, bronze, black, or custom color with sample)

- Performance requirements (thermal, wind load, impact rating if applicable)

- Project location (shipping calculation, code compliance verification)

Quote Turnaround: Typically 3–5 business days for standard specifications, 5–10 days for engineered systems requiring calculations.

When requesting proposals, providing complete specifications upfront (rather than iterative refinement) accelerates the process and ensures accurate initial pricing. Hotian’s engineering team can assist with specification development if project requirements remain undefined.

Commercial Storefront Windows (FAQs)

What is the average cost per square foot for commercial storefront windows?

- Frame material (aluminum vs. steel)

- Glass (single-pane vs. IGU)

- Performance (standard vs. thermal break / acoustic-rated)

What is the most cost-effective material for storefront systems?

- 25–35 year service life

- Low maintenance and good corrosion resistance

- Adequate performance for typical retail, restaurant, and office uses

How long does storefront window installation take?

- 1–2 storefronts: typically 3–5 days on site

- 6–10 storefronts: typically 10–15 days on site

- Standard systems: often 8–12 weeks material lead time

- Custom/high-performance: often 10–16 weeks

When should I replace rather than repair storefront windows?

- Frames show structural deterioration (corrosion, warping, broken welds)

- Weatherstripping/seals no longer hold and leaks recur

- The system fails current energy code requirements for your renovation scope

- You need meaningful thermal or acoustic upgrades

What’s the difference between commercial and residential storefront windows?

- Heavier-duty extrusions: commonly ~2–3 mm wall thickness vs. ~1–1.5 mm residential

- Larger glass lites: often 6–10 ft tall vs. 3–4 ft typical residential

- Code compliance: wind load, safety glazing, accessibility, and commercial hardware

- Process: professional installation, submittals, and sometimes engineering/certifications

How can I reduce storefront window costs without sacrificing quality?

- Factory-direct sourcing to reduce distributor markup (often cited as ~40–60% on materials)

- Volume ordering for multi-unit projects (often ~25–45% per-unit savings)

- Standard sizes vs. custom dimensions (often ~20–35% savings)

- Strategic performance specs (high-performance only on critical façades; standard elsewhere where allowed)

- Choose aluminum over steel when design allows (often ~20–40% savings)