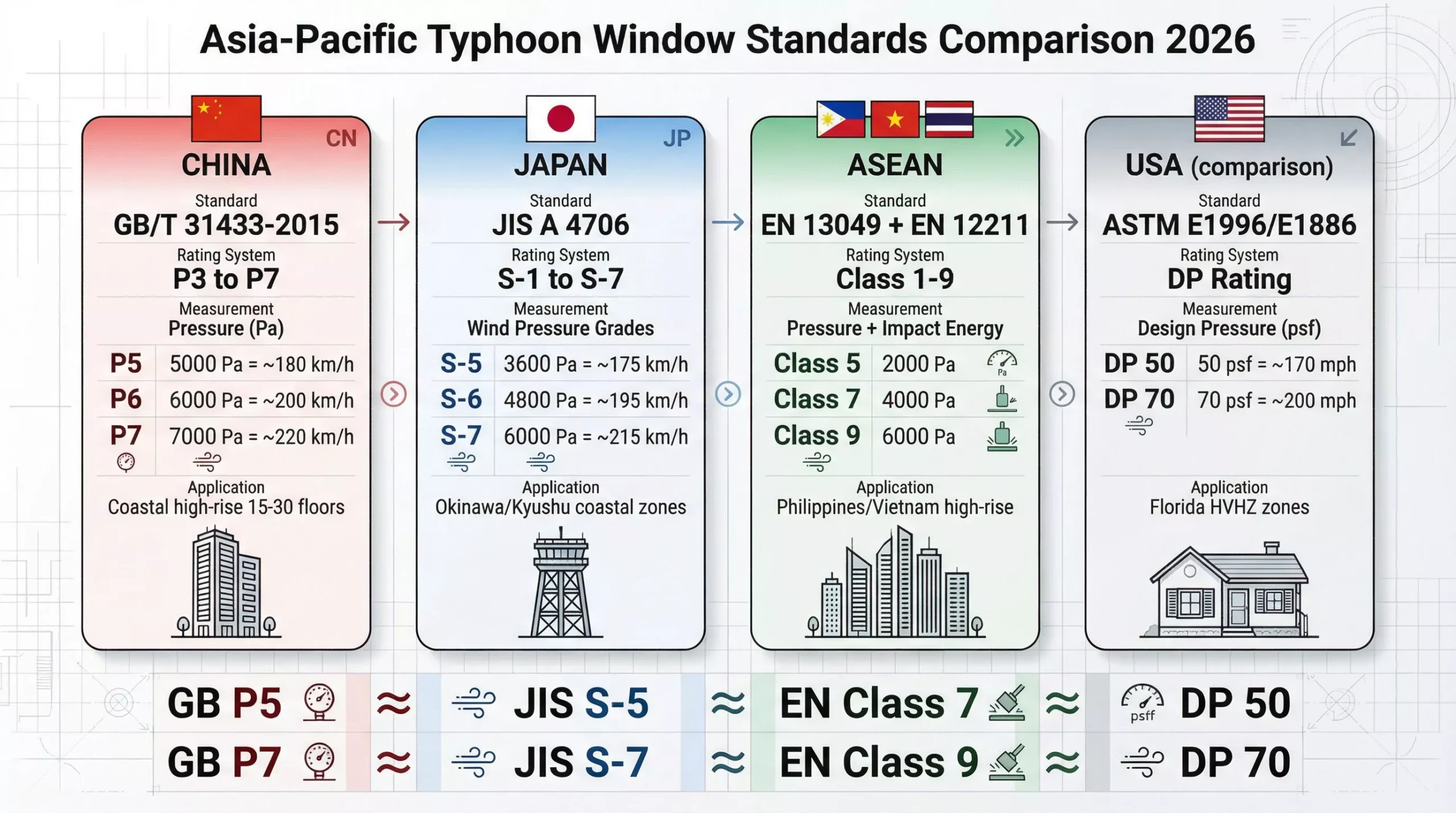

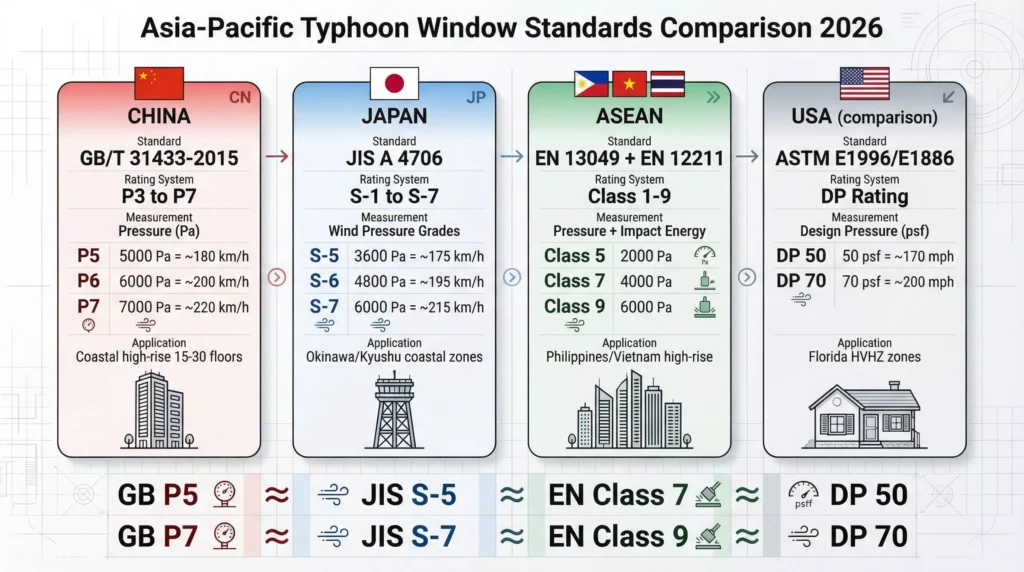

Typhoon impact windows in Asia-Pacific follow GB/T 31433-2015 (China), JIS A 4706 (Japan), and EN 13049 (ASEAN) standards, measuring performance through wind pressure resistance (Pa) and impact energy (J). In 2026, the minimum spec for coastal high-rises is P5 wind rating (≥5000 Pa, equivalent to ~180 km/h) with Class 5 impact resistance—but 30+ story buildings in Super Typhoon zones (Philippines, South China) now require P7 (≥7000 Pa, ~220 km/h) with SGP laminated glass.

Unlike low-rise residential markets in North America, Asia-Pacific’s typhoon protection is dominated by aluminum curtain wall systems for high-density urban towers. The 2026 shift: from “survive the storm” to “maintain building envelope integrity for 72+ hours” during multi-day Super Typhoon events like Haiyan (2013) or Mangkhut (2018).

If you want to understand how these Asian standards compare to the U.S. DP rating system, read our Hurricane Impact Window Ratings Guide for detailed DP50 vs. DP70 explanations.

Why 2026 Is the Turning Point for Asia-Pacific Typhoon Protection

1. Super Typhoon Frequency Escalation

Climate data shows Category 5-equivalent typhoons (sustained winds 250+ km/h) increasing by 15% per decade in the Western Pacific. What was once a “100-year storm” now occurs every 8-12 years in the Philippines and South China coastal zones.

2026 Reality: Manila, Shenzhen, Guangzhou, and Okinawa now experience 3-5 typhoon warnings annually, with at least one reaching Super Typhoon intensity. Building codes are racing to catch up.

2. Mandatory Code Upgrades Across the Region

| Country/Region | 2026 Enforcement | Key Requirement |

|---|---|---|

| China | GB 50009-2024 (Wind Load Code) | All coastal buildings >8 stories must use Class II typhoon-resistant systems |

| Philippines | NSCP 2025 Update | Metro Manila high-rises require Design Wind Speed 270 km/h compliance |

| Japan | Building Standard Law Amendment | Certification required for all glazing systems in “Typhoon Special Alert Zones” |

| Vietnam | QCVN 18:2025 | Ho Chi Minh City/Da Nang mandate impact testing for buildings >50m |

Financial Trigger: Insurance companies (Tokio Marine, PICC, BPI) now deny coverage or charge 40-60% premiums for non-compliant buildings.

3. High-Rise Construction Boom Meets Extreme Weather

Asia-Pacific accounts for 68% of global high-rise construction (buildings >100m). Unlike North America’s suburban sprawl, the region’s coastal cities grow vertically—creating unique typhoon vulnerabilities:

- Negative pressure zones at building corners (suction forces 2-3× baseline wind pressure)

- Curtain wall failures cascade: one broken panel creates building-wide pressure breaches

- Evacuation impossibility: You can’t evacuate 5,000 residents from a 50-story tower mid-typhoon

2026 Standard: Building envelope must remain 100% intact for 72 hours at design wind speed—no “acceptable” glass breakage.

Decoding Asia-Pacific Typhoon Standards

China: GB/T 31433-2015 Wind Pressure Classification

China’s national standard rates window performance by Pressure Resistance (Pa) rather than U.S.-style DP ratings:

| GB Rating | Pressure Resistance | Wind Speed Equivalent | Application |

|---|---|---|---|

| P3 | ≥3000 Pa | ~150 km/h | Inland cities, low-rise |

| P4 | ≥4000 Pa | ~165 km/h | Standard coastal residential |

| P5 | ≥5000 Pa | ~180 km/h | Coastal high-rise (15-30 floors) |

| P6 | ≥6000 Pa | ~200 km/h | Typhoon-prone zones (Guangdong, Fujian) |

| P7 | ≥7000 Pa | ~220 km/h | Super Typhoon zones (Hainan, HK, Macau) |

Critical Detail: GB standards measure uniform static pressure, while U.S. DP ratings include cyclic testing. For direct comparison: GB P5 ≈ DP 50, GB P7 ≈ DP 70. If you want to know the specific differences between DP50 and DP70 in detail, read our Hurricane Impact Window Ratings Guide.

Japan: JIS A 4706 Wind Resistance Grades

Japan uses a 7-tier “S-Grade” system (S-1 to S-7) based on building height and regional wind zones:

| S-Grade | Design Wind Pressure | Typical Use | Okinawa/Kyushu Requirement |

|---|---|---|---|

| S-3 | 1600 Pa | Standard residential | ❌ Insufficient |

| S-4 | 2400 Pa | Mid-rise urban | Minimum for 5-10 floors |

| S-5 | 3600 Pa | High-rise (10-20 floors) | Standard spec |

| S-6 | 4800 Pa | Typhoon zones >20 floors | Recommended for coastal |

| S-7 | 6000 Pa | Critical infrastructure | Required for oceanfront high-rises |

Unique Japanese Requirement: All typhoon-rated windows must also pass JIS R 3205 “disaster-grade laminated glass” standards—essentially requiring PVB or SGP interlayers even for non-impact zones.

Cultural Note: Traditional Amado (雨戸, storm shutters) still protect 40% of Japanese low-rise homes, but modern high-rises cannot use external shutters—making impact-resistant glazing the only option.

ASEAN: EN 13049 Adoption + Local Modifications

Vietnam, Thailand, Philippines, and Singapore largely adopt European EN standards with regional wind speed adjustments:

- EN 12211 (Wind Resistance): Class 5 = 2000 Pa, Class 9 = 6000 Pa

- EN 13049 (Impact Resistance): Uses steel ball drop test (mass × velocity) rather than 2×4 lumber

Philippines Specific: NSCP (National Structural Code) requires 270 km/h design wind speed for Metro Manila—this translates to approximately EN Class 9 + Large Impact Level D (borrowing U.S. missile test protocol).

High-Rise Typhoon Protection: Beyond Residential Standards

The Curtain Wall Challenge

Unlike North America’s window-in-wall construction, Asian high-rises use unitized curtain wall systems where glass panels form the primary building envelope. Failure modes are catastrophic:

Case Study Failure: 2018 Typhoon Mangkhut, Hong Kong

- A 40-story residential tower lost 12 curtain wall panels (4m × 2m each)

- Interior flooding reached 8 floors

- Repair cost: HK$15 million (~US$1.9M)

- Root cause: Standard 6mm tempered glass (non-laminated) shattered from flying debris

2026 Best Practice: All curtain walls in Typhoon Zone III (China classification) must use:

- 8mm + 1.52mm SGP + 8mm minimum laminated configuration

- Structural silicone rated for ±7000 Pa cyclic loading

- Multi-point pressure equalization drainage design

Corner Unit Premium: The Negative Pressure Zone

Wind engineering shows building corners experience suction forces 2.5-3× greater than flat facades due to Bernoulli effect.

Standard Solution: Corner units receive:

- +1 pressure class upgrade (if building spec is P5, corners get P6)

- Thicker glass: 10mm outer lite vs. 8mm standard

- Enhanced anchoring: Structural brackets every 400mm vs. 600mm standard

Cost Impact: Corner unit glazing costs 40-60% more—often passed to buyers as “premium view” pricing.

Height-Based Specification Matrix

| Building Height | Minimum Wind Rating | Impact Requirement | Typical Glass Build-up |

|---|---|---|---|

| 1-8 floors | P4 (4000 Pa) | Small debris (EN 13049) | 6mm + 0.76 PVB + 6mm |

| 9-20 floors | P5 (5000 Pa) | Medium impact | 8mm + 0.76 PVB + 6mm |

| 21-35 floors | P6 (6000 Pa) | Large impact (Level D) | 8mm + 1.52 SGP + 8mm |

| 36+ floors | P7 (7000 Pa) | Enhanced large impact | 10mm + 1.52 SGP + 8mm |

Coastal Modifier: Add +1 rating class if building is within 500m of shoreline.

Material Selection: Why Aluminum Dominates Asia-Pacific

Unlike North America where reinforced uPVC (vinyl) holds 45% market share for residential impact windows, Asia-Pacific is 90% aluminum for typhoon applications. Here’s why:

1. Structural Performance at Height

- uPVC Limitation: Even reinforced profiles deflect excessively beyond 2.5m spans—problematic for Asia’s large sliding doors and floor-to-ceiling windows

- Aluminum Advantage: 6063-T5 extrusions maintain structural integrity for 4m+ spans common in luxury apartments

2. Curtain Wall Integration

Modern high-rises use semi-unitized or stick curtain wall systems—all aluminum. Mixing materials (uPVC windows in aluminum curtain walls) creates:

- Thermal expansion mismatches (uPVC expands 5× more than aluminum)

- Aesthetic discontinuity

- Complex flashing and sealing transitions

3. Salt Corrosion Resistance

Coastal Asia faces extreme salt spray (800-1200 mg/m²/day vs. Florida’s 400-600). Solutions:

| Treatment | Lifespan (Coastal) | Cost Premium | Application |

|---|---|---|---|

| Mill Finish Aluminum | 3-5 years ❌ | Baseline | Avoid in coastal zones |

| Powder Coat (AAMA 2604) | 10-15 years | +15% | Standard residential |

| Anodized (Class II, 25μm) | 20-25 years | +30% | Commercial/luxury |

| PVDF Coating (Kynar 500) | 30+ years | +45% | Oceanfront, severe exposure |

Hotian Standard: All our Asia-Pacific typhoon systems use Class II anodizing or PVDF as a baseline—no mill finish options for coastal projects.

Steel/Iron Frames: The Heritage & Security Niche

While rare in new construction, steel frames serve two specialized markets:

1. Historic Building Retrofits

Colonial-era structures in Manila, Macau, Georgetown (Penang) require original sightline preservation—steel frames replicate traditional 1920s-1940s aesthetics while hiding modern laminated glass.

2. Ultra-Security Applications

Embassies, banks, and luxury villas in high-crime zones (parts of Manila, Jakarta) use steel frames + 21.52mm laminated glass (11 layers) for combined typhoon/ballistic protection.

Hotian Capability: We manufacture custom steel profiles with internal drainage channels and marine-grade powder coating—rare capability in the Asia market.

Real-World Project Case Studies

Case 1: Manila Bay Residential Tower (2024)

Project Profile:

- 42-story luxury condominium, Parañaque City

- 850 units, all with floor-to-ceiling sliding doors (3m × 2.4m)

- Site: 200m from Manila Bay shoreline

Typhoon Challenge:

- Must withstand Typhoon Haiyan-level winds (315 km/h gusts)

- NSCP 2025 requires 270 km/h sustained wind design

- Insurance mandate: Zero glass breakage during design-level event

Hotian Solution:

- Frame: 2.0mm wall-thickness thermally broken aluminum, PVDF silver finish

- Glass: 10mm + 2.28mm SGP + 8mm Low-E (U-factor 1.2, SHGC 0.28)

- Rating: P7 (7000 Pa) + Large Missile Level D equivalent

- Hardware: 316 stainless steel multi-point locks, EPDM gaskets

Results:

- Passed third-party EN 13049 + custom 270 km/h wind tunnel testing

- Delivered in 14 weeks (vs. 22-week quote from European supplier)

- Cost: 38% below imported European systems for equivalent spec

Case 2: Xiamen Oceanfront Hotel Curtain Wall (2025)

Project Profile:

- 28-story boutique hotel, Xiamen Bay

- Full-height atrium with 18m × 12m glass façade

- Exposure: Direct East China Sea wind fetch

Typhoon Challenge:

- Fujian Province requirement: GB P6 minimum for >20-floor buildings

- Architect demand: Ultra-clear glass for ocean views

- Structural engineer concern: Curtain wall spanning 6 floors without intermediate support

Hotian Solution:

- System: Stick curtain wall with 1.8m × 3.6m modular units

- Glass: 12mm ultra-clear + 2.28mm SGP + 10mm tempered (total 24.28mm)

- Frame: Custom 180mm-depth structural mullions, anodized champagne

- Engineering: Wind tunnel testing validated P6.5 performance (6500 Pa)

Innovation:

- Triple drainage plane design prevents water infiltration at 200mm/hr rainfall rates

- Seismic isolation joints every 3 floors (Xiamen Seismic Zone III)

Client Feedback: System survived Typhoon Doksuri (2023) with zero damage while neighboring building (non-laminated glass) had 40% glass breakage.

Case 3: Okinawa U.S. Military Base Retrofit (2026)

Project Profile:

- 1970s-era barracks and admin buildings, Camp Foster

- 2,400 window units across 18 buildings

- Budget: DoD procurement with “Buy America” waiver for performance

Challenge:

- Existing buildings: Single-pane aluminum windows with zero typhoon resistance

- Operational requirement: Buildings must remain functional during typhoon evacuations

- Timeline: Complete before 2026 typhoon season (May start)

Hotian Solution:

- Retrofit System: Custom aluminum sub-frames that install into existing openings (zero masonry work)

- Glass: 6mm + 1.52mm PVB + 6mm (meets JIS S-6 for Okinawa)

- Fast-track: Pre-fabricated units with bolt-in installation (4 units/day per crew)

Results:

- Project completed in 11 weeks (January-March 2026)

- All 2,400 units tested to JIS A 4706 S-6 standard

- Cost: US$1,850 per unit installed (42% below domestic U.S. suppliers)

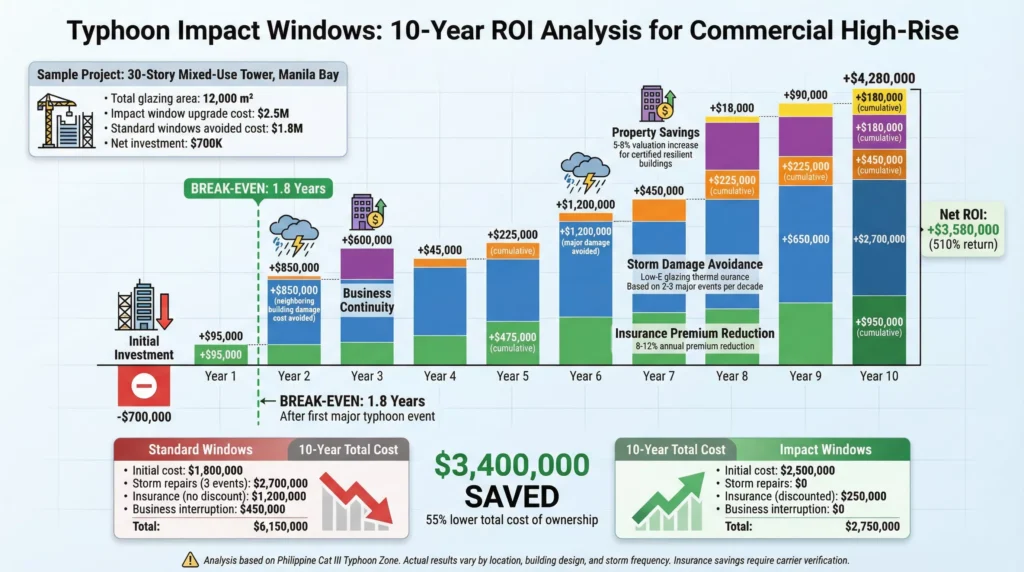

Investment ROI: The Hidden Costs of Typhoon Vulnerability

Beyond Physical Damage: Business Continuity Loss

While North American hurricane analysis focuses on insurance savings, Asia-Pacific’s ROI calculation centers on operational downtime:

Commercial High-Rise (30 floors, mixed-use):

- Typhoon Warning Issued (T-48 hours): Retail tenants close, offices evacuate

- Standard Glass Building: 5-7 day closure post-storm (damage assessment + repairs)

- Impact-Rated Building: 0-1 day closure (visual inspection only)

Cost of Extended Closure:

| Tenant Type | Daily Revenue Loss | 7-Day Total Loss |

|---|---|---|

| Grade-A Office (per floor) | $12,000 | $84,000 |

| Retail (ground floor) | $35,000 | $245,000 |

| Residential (tenant relocation) | $8,000/floor | $56,000 |

| Building Total (30 floors) | — | $1.2M – $2.8M |

Payback Calculation:

- Impact window upgrade cost: $2.5M (whole building)

- Annual typhoon risk: 3-5 warnings, 1-2 direct hits

- Break-even: 1.5-2 major typhoon events (typically 3-5 years in high-risk zones)

Insurance & Financing Incentives

China: PICC and Ping An offer 8-15% premium reductions for GB P6+ certified buildings

Philippines: BPI and BDO provide Green Building Loans (0.5% rate reduction) for typhoon-resilient construction

Japan: Government subsidy covers 20% of retrofit costs for buildings upgraded to post-2020 standards

Common Specification Mistakes That Cost Millions

❌ Mistake #1: Applying Residential Standards to High-Rises

- Problem: Specifying P4 (4000 Pa) windows for a 25-story tower because “it’s residential”

- Reality: Height amplifies wind speed—a P4 window rated for 165 km/h at ground level experiences 200+ km/h equivalent forces at 80m height

- Fix: Use height-based specification matrix (shown earlier). Add +1 rating per 20 floors.

❌ Mistake #2: Ignoring Regional Wind Zone Sub-Classifications

- Problem: Using uniform P5 spec for all units in a 40-story tower

- Fix: Divide building into wind exposure zones:

- Reality: Corner units, top 5 floors, and mechanical equipment screen areas experience 2-3× baseline pressure

- Zone A (standard): P5

- Zone B (corners, top floors): P6

- Zone C (rooftop, parapets): P7

Costs 12% more but prevents 90% of typhoon failures.

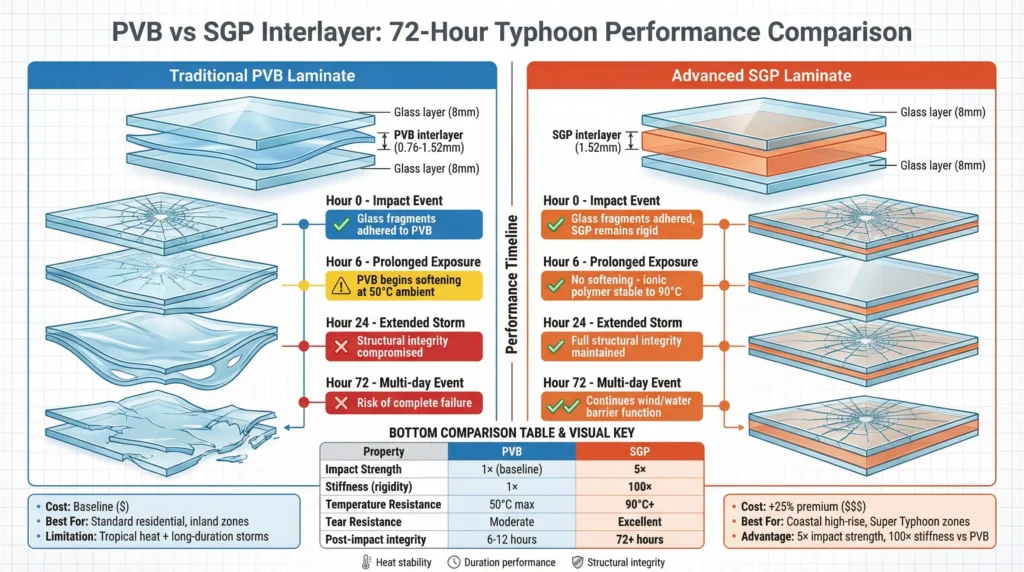

❌ Mistake #3: PVB Interlayer for Extended Exposure

- Problem: Specifying standard 0.76mm PVB laminate for Super Typhoon zones

- Reality: PVB softens above 50°C—in tropical climates with 6+ hour storm duration, PVB-laminated glass can sag and eventually tear

- Fix: Mandate SGP interlayer (1.52mm minimum) for:

- Buildings within 1km of coastline

- Any project in Philippines Typhoon Category III zones

- All P6+ rated systems

SGP costs 25% more but maintains rigidity for 72+ hours.

❌ Mistake #4: Overlooking Drainage System Capacity

- Problem: Focus entirely on wind/impact ratings, ignore water infiltration design

- Reality: Super Typhoons dump 200-400mm rain in 6 hours—standard curtain wall drainage (designed for 50mm/hr) overflows, flooding interiors

- Fix: Specify triple-plane drainage design with:

- Primary barrier: Structural silicone seal

- Secondary barrier: Compression gasket

- Tertiary barrier: Internal weep channels (minimum 800mm²/m run)

2026 Specification Checklist for Typhoon Projects

Before Tender Issue

✅ Wind Zone Verification

- Obtain site-specific wind study (not just city-wide code minimums)

- Identify negative pressure zones (building corners, rooftop areas)

- Calculate height-adjusted wind speeds for top 20% of floors

✅ Code Compliance Matrix

- China: GB 50009-2024 (Wind Load) + GB/T 31433-2015 (Window Performance)

- Philippines: NSCP 2025 Wind Chapter + DOE Energy Code glazing limits

- Japan: Building Standard Law + regional prefecture addendums

- Vietnam: QCVN 18:2025 + TCVN on impact resistance

✅ Material Pre-Selection

- Aluminum mandatory for buildings >15 floors or curtain wall applications

- uPVC acceptable for low-rise (<8 floors) and small openings (<2m width)

- Steel only for heritage retrofits or ultra-security requirements

✅ Glazing Performance Targets

- Wind Rating: Minimum P5 (5000 Pa) coastal, P6 (6000 Pa) for high-rise

- Impact: Large Missile Level D equivalent for floors 1-10

- Thermal: U-factor ≤1.8 W/m²K (China GB), ≤2.0 (ASEAN)

- Solar: SHGC 0.25-0.35 for tropical climates (balance view + cooling load)

✅ Interlayer Specification

- PVB: Acceptable for P4-P5 inland projects with <50km coastal distance

- SGP Mandatory: All P6+, oceanfront (<1km), Philippines Cat III zones

✅ Testing & Certification Requirements

- Third-party lab testing (China: CABR; International: Intertek, SGS)

- Provide test reports showing: Wind cyclic, static pressure, impact resistance, water penetration

- State-specific certifications (China CCC, Philippines ICC, Japan JIS mark)

✅ Installation Standards

- Anchor spacing: Maximum 400mm for typhoon zones (vs. 600mm standard)

- Structural silicone: Minimum 12mm bite, 2-component fast-cure (3-day)

- Flashing integration: Pre-fabricated flexible membrane systems (not field-applied sealants)

FAQ: Asia-Pacific Typhoon Windows

Can I use U.S. HVHZ-rated windows in Asia?

Technically, sometimes—practically, it’s usually not the best path. High-performing U.S. systems (e.g., HVHZ products tested to high DP levels) can meet or exceed the engineering intent of many APAC typhoon specs. But there are common obstacles:

- Certification doesn’t transfer: local building approval typically requires local product approvals or testing to the local standard (e.g., GB/JIS) and local reporting formats.

- Dimensional mismatch: many U.S. systems are optimized for inch-based modules; APAC projects are typically metric and modularized differently.

- Delivered cost: international freight, crating, duties, and local compliance steps can add ~40–60% to landed cost.

- Lead time: imported systems can run ~16–22 weeks vs. ~8–12 weeks from regional suppliers (varies by project and finish).

Better solution: use a manufacturer that can build to your project geometry and test/report to both ASTM and GB/JIS (where required), so performance and approval align.

What’s the real difference between P5 and P6 ratings?

Pressure rating. In many specs, P5 ≈ 5000 Pa and P6 ≈ 6000 Pa. That’s a meaningful jump in design load and typically demands stronger frames, glass, and anchorage.

In practical terms:

- P5: commonly specified for severe typhoon exposure when some controlled damage/deformation may be acceptable depending on the performance criteria.

- P6: typically targeted where higher safety margins and tighter performance criteria are required (especially for critical elevations/corners).

Cost difference: P6 systems often cost ~18–25% more due to:

- Thicker aluminum profiles (commonly ~2.0 mm vs. 1.8 mm wall thickness)

- Upgraded laminated glass packages (often moving from PVB to SGP interlayers and/or thicker lites)

- Stronger anchors, brackets, and fasteners

If you want a side-by-side mapping between Asian P-ratings and the American DP system (e.g., DP50 vs DP70), include a short link to your internal guide here.

Do I need different specs for different sides of the building?

Yes. Wind pressures vary dramatically by façade, height, and geometry. Typical design patterns (subject to your wind engineer’s report):

- Windward face: 100% of design pressure

- Leeward face: ~40–60% of design pressure

- Side walls: ~70–80% of design pressure

- Corners/edges: can see ~250–300% localized suction (negative pressure)

Cost optimization: many developers specify higher ratings at the highest-risk zones and lower elsewhere (where code allows), e.g.:

- P6 at windward + corners

- P5 at side walls

- P4 at leeward areas (if permitted)

This approach can reduce total window cost by ~12–18% without compromising the engineered safety intent—when supported by the wind-load schedule.

How long does curtain wall installation take?

For a typical 30-story tower, planning ranges are often:

- Unitized system: ~2.5–3.5 months (faster, higher material/logistics cost)

- Stick system: ~4–6 months (lower material cost, more weather-dependent)

- Hybrid: ~3–4.5 months (balance of speed and cost)

Typhoon season planning: avoid scheduling final enclosure/installation during June–October (typical peak period). Many insurers restrict or exclude storm losses on incomplete/partially sealed façades—confirm with your project insurer.

Can existing buildings be retrofitted for typhoon performance?

Yes. Common retrofit paths include:

| Retrofit method | Disruption | Typical performance gain | Best use case |

|---|---|---|---|

| Glass-only replacement | Low | ~40–60% | Frames are in good condition (often aluminum) and anchors are verified |

| Frame + glass retrofit | Moderate | ~80–90% | When existing frames/hardware are the limiting factor |

| Secondary glazing | Low–Moderate | ~30–50% | Budget-driven upgrades or interior-only interventions |

Best ROI: glass-only retrofits can work well when existing frames are sound and you can upgrade to laminated glass with SGP interlayer (where appropriate) and confirm anchors/edge conditions.

When to avoid: buildings 25+ years old with original frames and unknown anchorage may not meet current load paths—engineering verification is essential before investing in glass upgrades.

Hotian Typhoon Systems: Engineered for Asia-Pacific Scale

For Developers, Contractors & Façade Specialists: Source typhoon-rated window and curtain wall systems built to your specifications—delivered faster and more cost-effectively than European imports.

Request Custom Quote →

Download Spec Sheets →

Schedule Engineering Call →

Why Asia-Pacific Projects Choose Hotian

1. Tri-Material Manufacturing Platform

Complete in-house production for all three frame systems:

Thermally Broken Aluminum Alloy (Primary Recommendation)

- Custom extrusion dies for project-specific profiles

- Wall thickness: 1.8mm-3.0mm (tailored to wind rating requirements)

- Thermal break: PA66 GF25 polyamide strips (14.8mm-34mm depth options)

- Finish options: PVDF (Kynar 500), Class II anodizing, powder coat (AAMA 2605)

- Capacity: 15,000 m² curtain wall per month

Reinforced uPVC (Cost-Effective Low-Rise)

- Multi-chamber profiles (5-7 chambers) with galvanized steel reinforcement

- Ratings achievable: P4-P5 (suitable for buildings <15 floors)

- Color options: White, grey, woodgrain laminates

- Ideal for: Residential developments, inland projects, budget-conscious specs

Steel/Iron Systems (Specialty Applications)

- Hollow structural sections (HSS) with internal drainage channels

- Marine-grade powder coating (600+ hours salt spray resistance)

- Use cases: Heritage retrofits, ultra-security applications, architectural feature windows

- Capacity: Custom project basis (typically 500-2000 units/project)

2. Multi-Standard Certification Capability

Unlike regional suppliers limited to one standard, Hotian provides testing and documentation for:

✅ China GB/T 31433-2015: P3 through P7 ratings, full test reports from CABR (China Academy of Building Research)

✅ Japanese JIS A 4706: S-grade testing available through SGS Tokyo lab partnership

✅ European EN 13049 + EN 12211: For ASEAN markets (Vietnam, Thailand, Philippines) requiring European standard compliance

✅ U.S. ASTM E1996/E1886: Available for projects requiring ASTM equivalency (U.S. military bases, international schools, embassy compounds)

Documentation Package: Every project receives:

- Third-party test reports (wind, water, impact)

- Material certificates (aluminum mill certs, glass composition)

- Installation drawings and specifications

- O&M manuals in English + Chinese

3. Rapid Asia-Pacific Logistics

Lead Time Comparison (from order to job site delivery):

| Origin | Philippines | Vietnam | South China | Japan | Indonesia |

|---|---|---|---|---|---|

| European Supplier | 18-22 weeks | 16-20 weeks | 14-18 weeks | 16-20 weeks | 20-24 weeks |

| Hotian (China) | 8-10 weeks | 7-9 weeks | 6-8 weeks | 9-11 weeks | 10-12 weeks |

Why This Matters:

- Faster delivery = earlier building closeout = revenue generation starts sooner

- Reduced on-site storage time (typhoon damage risk to stored materials)

- Better cash flow (shorter gap between payment and installation)

Shipping Options:

- Container (FCL): Most economical for full-building orders

- LCL: Available for smaller retrofit projects

- Air freight: Emergency replacement units (2-3 week delivery for critical repairs)

4. Technical Support in Your Language

Bilingual Engineering Team (English + Mandarin Chinese):

- Pre-tender: Wind load calculations, preliminary specs, budgetary pricing

- Design phase: Shop drawing review, submittal preparation, value engineering

- Installation: On-site technical support (available for projects >5,000 m²)

Regional Representation:

- Philippines: Manila-based distributor with sample showroom (Makati)

- Vietnam: Technical sales office in Ho Chi Minh City

- Thailand: Partnership with established curtain wall contractors (Bangkok)

Response Time:

- Email inquiries: <24 hours (Asian business hours)

- Technical drawings: 3-5 business days

- Formal quotes: 48-72 hours with preliminary specs

Typical Project Engagement Process

Phase 1: Specification Development (Week 1-2)

You Provide:

- Architectural drawings (floor plans, elevations)

- Wind study report (or site location for us to assess)

- Target budget per m² or per unit

- Performance requirements (thermal, acoustic, security beyond typhoon)

- Aesthetic preferences (color, finish, sightline dimensions)

Hotian Delivers:

- Preliminary system recommendation (aluminum/uPVC, rating class)

- Glass build-up options (PVB vs SGP, Low-E configurations)

- Budget pricing (±15% accuracy at this stage)

- Applicable test reports and certifications

Phase 2: Sampling & Approval (Week 3-6)

Standard Samples (No-charge for serious projects):

- Aluminum extrusion cut samples (300mm lengths, all finishes)

- Glass samples (300mm × 300mm, showing actual interlayer)

- Hardware samples (handles, locks in specified finish)

Functional Prototypes (For projects >$500K):

- Full-size mockup unit (typical: 1.5m × 2.0m operable window)

- Shipped to job site or testing lab

- Client can arrange independent testing if desired

Approval Deliverables:

- Finalized shop drawings

- Confirmed pricing (locked for 90 days)

- Production schedule

Phase 3: Manufacturing & QC (Week 7-14)

Production Milestones:

- Week 7-8: Frame extrusion/fabrication, glass ordering

- Week 9-11: Assembly, glazing, hardware installation

- Week 12-13: Factory QC (air/water testing of sample units)

- Week 14: Packing and containerization

Quality Control:

- Frame inspection: Dimensional tolerance ±0.5mm, weld/corner joint strength testing

- Glazing: Edge seal integrity, laminate adhesion (destructive sample testing)

- Performance: Random unit selection for air/water leakage chamber testing

Optional Third-Party Inspection: SGS, Intertek, or Bureau Veritas can witness production (cost: $1,200-$2,000, adds 3-5 days)

Phase 4: Delivery & Installation Support (Week 15-18)

Logistics:

- Containerization: Protective packaging, custom crating for oversized units

- Documentation: Commercial invoice, packing list, certificates of origin, test reports

- Customs coordination: HS code classification, duty calculation assistance

Installation Support (For projects >10,000 m²):

- On-site technical representative (1-2 weeks, travel/accommodation costs separate)

- Installation training for local crew

- Quality assurance inspections at key milestones

Warranty:

- Frame & Finish: 10 years (15 years for PVDF/anodized in non-marine environments)

- Insulated Glass Seal: 5 years

- Hardware: 3 years (5 years for stainless steel marine-grade)

Reference Project Portfolio (2022-2026)

High-Rise Residential: 24 projects across Philippines, Vietnam, China (Guangdong, Fujian, Hainan)

- Tallest: 52 stories (Cebu City, Philippines)

- Largest: 1,200 units (Ho Chi Minh City mixed-use)

Commercial/Hospitality: 15 projects

- Notable: Oceanfront resort (Sanya, Hainan) – P7 rated curtain wall, survived Typhoon Saola (2023) with zero damage

Government/Institutional: 8 projects

- Schools, hospitals, military facilities (Okinawa, Guam, Philippines)

Total Installed: >850,000 m² of typhoon-rated systems (2022-2026)

Get Started: Three Ways to Engage

Option 1: Fast-Track Quote (48-72 Hours)

Best for: Projects in tender phase with defined specs

📧 Email Requirements:

- Project location & building height

- Total glazing area (m²) or unit count

- Target wind rating (GB P-class, JIS S-grade, or design wind speed)

- Frame preference (aluminum/uPVC/steel)

- Any special requirements (blast resistance, high acoustic rating, etc.)

You Receive:

- Budgetary pricing (per m² installed)

- System recommendation with technical rationale

- Sample test reports

- Preliminary lead time estimate

Option 2: Detailed Specification Development (2-Week Process)

Best for: Design-phase projects needing value engineering

📋 Process:

- Submit architectural drawings + performance requirements

- Hotian engineers perform wind load analysis

- Receive 3 system options (good/better/best) with cost-performance comparisons

- Virtual or in-person meeting to review recommendations

- Finalized specification with locked pricing

Deliverables:

- Technical specification (ready for tender documents)

- CAD shop drawings (preliminary)

- BIM models (Revit, optional)

- Material data sheets and test reports

Option 3: Sample Unit Program (6-8 Weeks)

Best for: Large projects requiring physical validation before commitment

🏗️ Program Structure:

- Hotian fabricates 1-2 full-size units to your exact specifications

- Delivered to your location or testing lab

- You can arrange independent testing (ASTM, EN, GB) at your cost

- If approved, unit cost is credited against final order (for orders >$300K)

Investment: $3,500-$6,500 per sample unit (including shipping to ASEAN/China destinations)

Contact Information

Project Inquiries: [Your Email]

Technical Support: [Your Email]

Sample Requests: [Your Email]

Office Hours: Monday-Friday, 9:00-18:00 CST (UTC+8)

Emergency Contact (typhoon season project support): [Your Phone]

Final Consideration: The True Cost of Underspecification

In 2026’s Asia-Pacific market, the gap between “code minimum” and “performance-based design” has never been more critical.

A developer who specifies P5 windows for a 30-story oceanfront tower in Manila might save $400,000 in initial construction costs. But when the next Super Typhoon makes landfall:

- Glass replacement: $800,000-$1.2M (if available quickly)

- Interior water damage: $2M-$5M (flooded units, electrical, MEP)

- Business interruption: $1.5M-$3M (rental income loss, tenant relocation)

- Reputation damage: Immeasurable (poor reviews, difficulty leasing, reduced resale value)

The total cost of failure: $4.3M-$9.2M to save $400K.

2026 Reality: Insurance companies increasingly deny claims for “insufficient specification”—if your windows don’t meet the design wind speed for your location, you may have zero coverage.

Choose specifications based on risk engineering, not just code compliance. The best typhoon window is the one that makes the typhoon irrelevant to your building’s operation.

Protect your investment. Specify with confidence. Build for the next 50 years of climate reality.