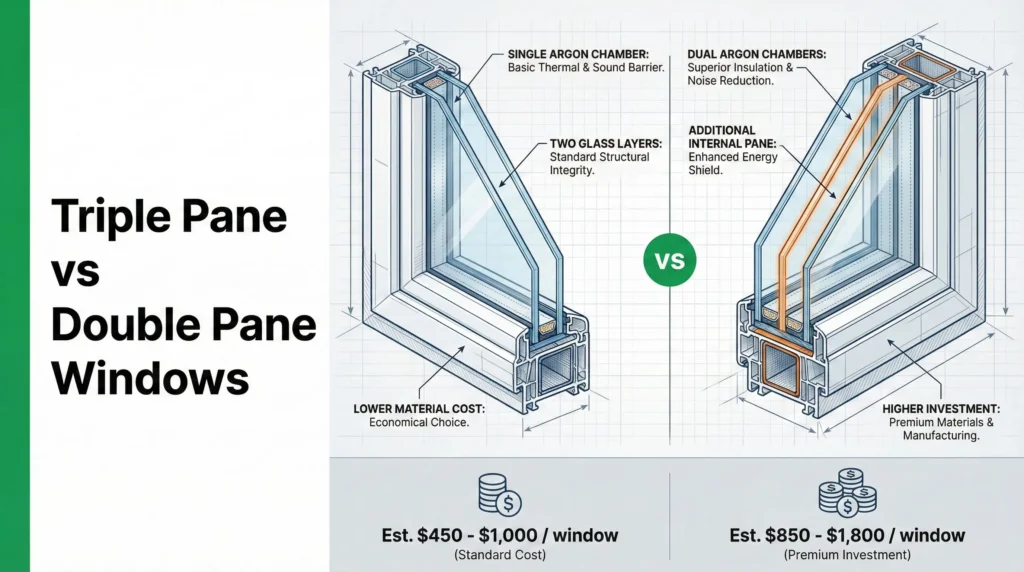

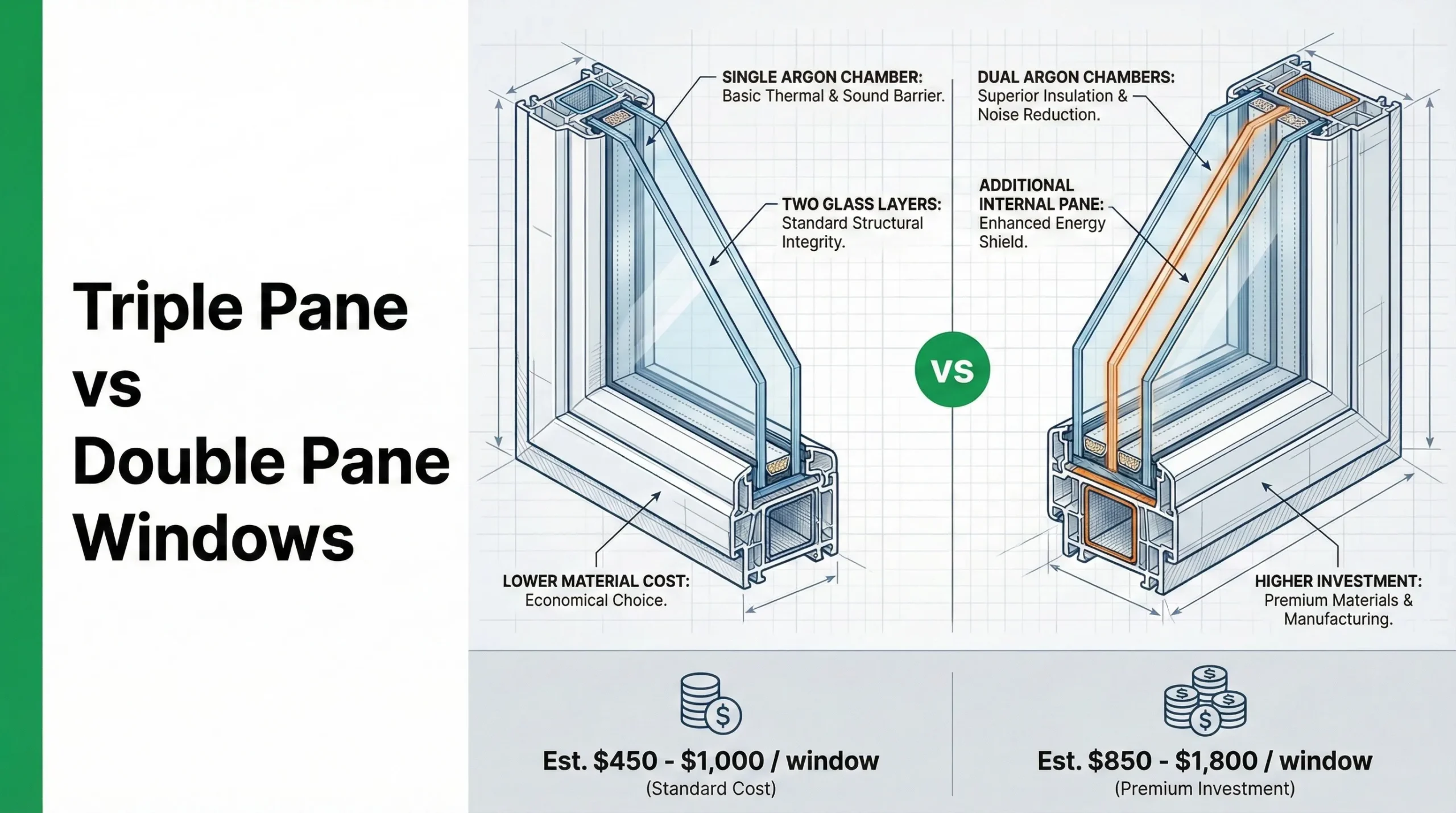

Commercial window replacement costs typically $450-1,800 per window installed, or $50-150 per square foot, depending on material and performance requirements. Material selection: aluminum with thermal break for most commercial projects ($630-950/window, 40-50 year lifespan, U-factor 0.30-0.42), vinyl for budget-conscious mid-rise ($450-720/window, 25-30 years, U-factor 0.25-0.35), steel for signature buildings ($1,260-2,200/window, 50-60 years). Performance requirements: NFRC-rated U-factor ≤0.40 (ASHRAE 90.1 compliance), wind load rating ±30-60 PSF based on building height, Miami-Dade NOA certification for coastal hurricane zones where required. Supplier evaluation: verify AAMA certification from independent labs (not self-certified), minimum 10-year material warranty, MOQ flexibility for project size, engineering submittal support. Project timeline: 10-14 weeks lead time for standard specifications, 2-4 weeks installation per 100 windows.

Critical decision: replace when repair costs exceed 50% of replacement cost, or when windows are beyond their rated lifespan (25+ years vinyl, 35+ years aluminum). Factory-direct sourcing from manufacturers like Hotian typically eliminates 40-60% distributor markup, saving up to $120-200 per window on projects exceeding 150 windows while maintaining full certification compliance.

Why Commercial Window Replacement Decisions Carry High Stakes

At Hotian, we manufacture commercial windows for multiple projects across North America, Asia, and other regions—from mid-rise apartments requiring acoustic isolation to high-rise office buildings in demanding climates and institutional buildings designed for long-term durability.

The pattern we see repeatedly in projects we review: Projects that invest proper time in specification and supplier evaluation typically experience far fewer failures over the first decade. Projects that accept low-bid “equivalent” substitutions without verification often experience higher failure rates within 5 years—requiring costly building envelope remediation.

A typical scenario: A 12-story commercial building accepted an unauthorized window substitution to save $18K (10% of budget). The substitute windows failed structural testing at mockup (wind load rated ±35 PSF vs required ±45 PSF). Result: $92K cost overrun to reorder compliant windows + 10-week schedule delay that triggered $34K in construction loan interest penalties. Total loss: $126K to save $18K—a 7× negative return.

The financial comparison:

- ✅ Correct specification: $780/window × 180 windows = $140K total investment, zero rework

- ❌ Failed substitution: $122K original cost + $92K remediation + $34K delay penalties = $248K total loss

This guide provides the framework to avoid that outcome. You’ll learn: how to budget accurately by material and project type, when replacement makes more financial sense than repair, material selection criteria by building characteristics, supplier evaluation to prevent costly failures, and performance specifications that matter for code compliance.

Commercial Window Replacement Cost Breakdown

Generic cost guides list price ranges but don’t explain the variables that drive 4× cost differences. Understanding these factors lets you budget accurately and identify which cost-cutting measures save money vs which create expensive problems.

Cost by Material Type & Performance

Two pricing methods dominate commercial projects:

- Per-window pricing: Standard for mid-rise buildings with discrete window openings (typical 15-30 sq ft units)

- Per-square-foot pricing: Common for storefront and curtain wall systems (continuous glass areas 50+ sq ft)

Most contractors quote by window unit for replacement projects. Per-square-foot pricing appears in new construction or when replacing entire facade sections.

Standard commercial window replacement (project size: 50-200 windows, typical 3′ × 5′ units):

| نوع المادة | التكلفة لكل نافذة | Cost per Sq Ft | Installation Included | عمر | أفضل تطبيق |

|---|---|---|---|---|---|

| Vinyl (standard) | $450-660 | $50-75 | ✓ Yes | 25-30 سنة | Budget mid-rise, mild climates |

| Vinyl (high-performance) | $580-800 | $65-90 | ✓ Yes | 30-35 years | Energy-focused residential, cold climates |

| Aluminum (standard) | $630-850 | $70-95 | ✓ Yes | 35-40 years | Most commercial applications |

| Aluminum (thermal break) | $780-1,150 | $85-125 | ✓ Yes | 40-50 years | High-rise, cold climates, LEED projects |

| Aluminum (impact-rated) | $1,000-1,560 | $110-150 | ✓ Yes | 40-50 years | Coastal hurricane zones, code-required |

| Steel (architectural) | $1,260-2,200 | $140-180 | ✓ Yes | 50-60 years | Historic renovation, signature buildings |

Note: Prices reflect fully installed costs including frame, glazing, flashing, and labor for typical building access conditions. Difficult access (15+ floors interior-only) or winter installation adds 20-40%.

Volume Discount Economics

Project scale dramatically impacts per-unit cost due to manufacturing batch efficiency and shipping container economics. Most manufacturers offer volume tiers:

| حجم المشروع | Per-Window Cost (Aluminum) | Volume Discount | Why This Tier Exists |

|---|---|---|---|

| 20-50 windows | $820 | Baseline (0%) | Standard production run, mixed containers |

| 50-150 windows | $720 | 12% savings | Single-batch production efficiency |

| 150-300 windows | $650 | 21% savings | Full container load (20-24 units/container) |

| 300-500 windows | $600 | 27% savings | Multi-container volume, dedicated production run |

| 500+ windows | $560-580 | 29-31% savings | Partnership pricing, long-term commitment |

Typical cost scenario for a 240-window mid-rise project: Initial distributor quote: $820/window × 240 = $196,800. Factory-direct quote with volume tier: $650/window × 240 = $156,000. Savings: $40,800 (21%) while maintaining identical NFRC/AAMA certifications.

💡 Manufacturer Insight:

Factory-direct sourcing typically eliminates distributor markup (often 40-60% of wholesale cost). On projects exceeding 150 windows, this translates to up to $120-200 per window savings. However, verify the manufacturer provides full engineering support—submittal packages, CAD drawings, structural calculations—that distributors typically handle. At Hotian, our project management team provides these services at no additional cost for commercial projects.

Three Cost Variables That Drive 2-4× Price Differences

Beyond material type and volume, three specifications create substantial cost variation:

Variable #1: Thermal Performance Requirements

| U-Factor Target | When Required | خيارات المواد | تأثير التكلفة | Energy ROI |

|---|---|---|---|---|

| 0.50-0.60 | Mild climates only (Zones 1-2) | Standard aluminum, single vinyl | خط الأساس | Minimal heating/cooling |

| 0.35-0.45 | Most commercial (Zones 3-5) | Thermal break aluminum, quality vinyl | +15-25% | 8-12 year payback (mixed climate) |

| 0.28-0.35 | Cold climates (Zones 5-7) | Triple-glazed, premium thermal break | +40-65% | 5-9 year payback (high heating cost) |

| <0.25 | Passive house, net-zero | Fiberglass, European systems | +80-120% | Long-term operational savings |

Cost example (150-window office, Denver climate Zone 5):

- Standard aluminum U-0.45: $780/window = $117,000 installed

- High-performance U-0.30: $1,050/window = $157,500 installed

- Premium: $40,500 (35% more)

- Annual energy savings: Typically $3,000-5,000 (heating cost reduction) = 8-13 year payback

When to pay the premium: Cold climates (Zone 5+), buildings with 30+ year ownership horizon, LEED certification projects where envelope performance contributes to energy credits worth $80-200K in tax incentives.

Variable #2: Wind Load & Building Height

Building height determines required wind load rating. Under-specifying creates structural failure; over-specifying wastes money.

| ارتفاع المبنى | Design Pressure (Typical) | Required Window Rating | Cost vs Baseline |

|---|---|---|---|

| 1-6 stories | ±25-30 PSF | ±30 PSF minimum | خط الأساس |

| 7-12 stories | ±35-45 PSF | ±45 PSF minimum | +18-25% |

| 13-20 stories | ±45-60 PSF | ±60 PSF minimum | +35-50% |

| 21-35 stories | ±60-80 PSF | ±80 PSF minimum | +55-75% |

Critical specification error we see frequently: Architect specifies “±40 PSF windows” for 15-story building based on mid-height calculation, but building code requires ±50 PSF at upper floors. Contractor orders uniform ±40 PSF windows to save 20%. Result at mockup testing: structural failure. Entire order must be scrapped.

Correct approach: Calculate design pressure per ASCE 7 for worst-case location (typically top floors, corner exposure), specify windows rated 1.5× design pressure (safety factor), verify supplier provides test reports from independent ASTM E330-certified labs.

Variable #3: Impact Resistance (Coastal Zones)

Hurricane-prone regions require impact-rated windows by code. This is non-negotiable for insurance and certificate of occupancy.

| موقع | متطلبات | شهادة | Cost Impact vs Standard | Insurance Benefit |

|---|---|---|---|---|

| Inland (non-HVHZ) | لا أحد | Standard AAMA | خط الأساس | Standard rates |

| Coastal (HVHZ) | Large missile impact | Miami-Dade NOA, ASTM E1886/E1996 | +80-120% | 25-40% premium discount |

| Texas coast | Windborne debris | TAS 201-203, TBCE | +70-100% | 20-30% discount |

HVHZ = High Velocity Hurricane Zone (Florida coastal areas, wind speed >130 mph per building code).

Real cost comparison (120-window coastal condo, Miami):

- Standard vinyl windows: $620/window = $74,400

- Impact-rated ميامي ديد NOA: $1,180/window = $141,600

- Premium: $67,200 (90% more)

- Insurance savings: 30% discount on $9,500 annual premium = $2,850/year → 23.5-year payback

- But compliance is mandatory—non-impact windows void insurance and prevent occupancy certificate.

Material Selection by Building Type & Requirements

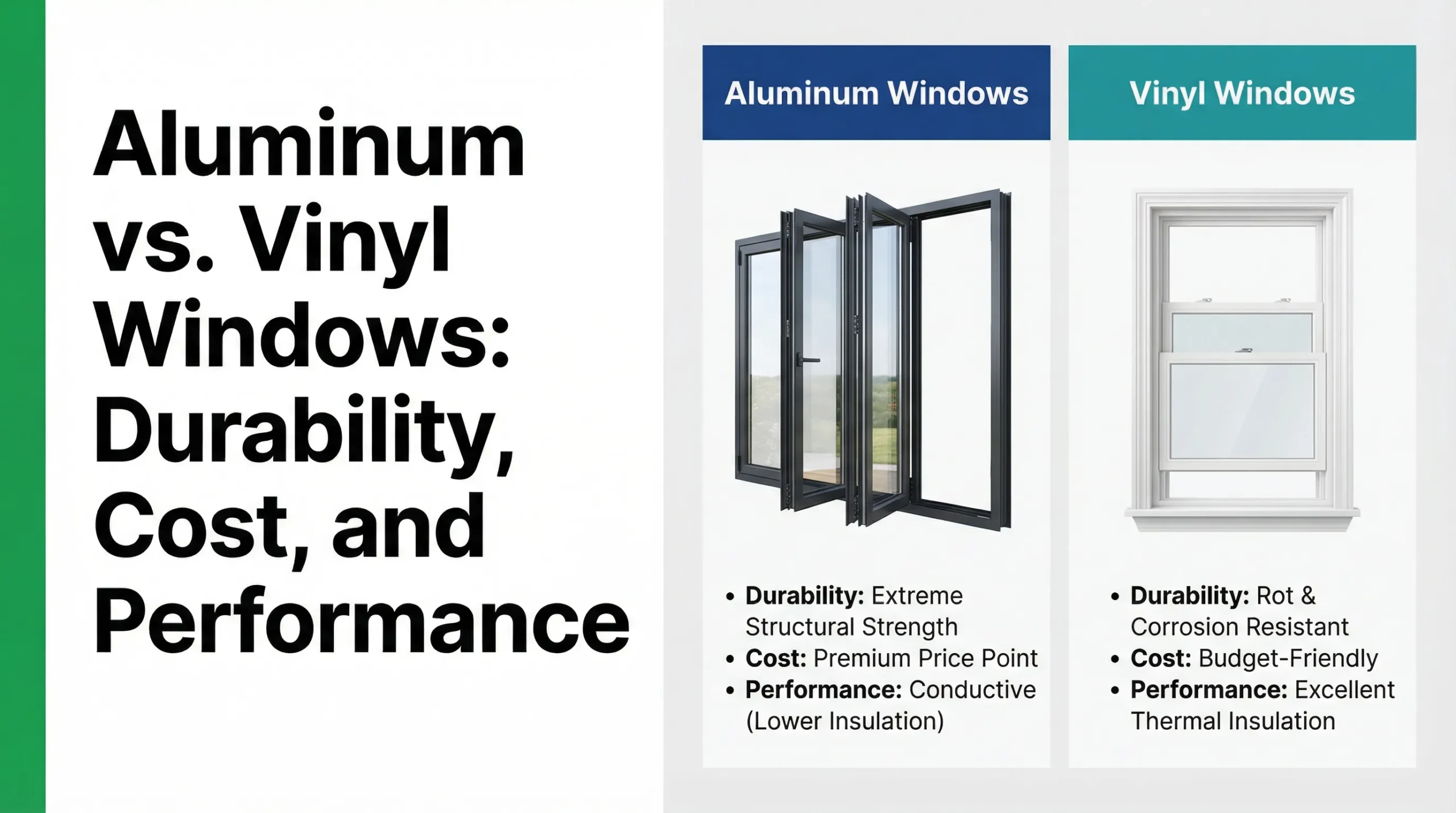

The most expensive commercial window mistake: choosing material based on initial cost without considering building characteristics. Vinyl in 15+ story buildings fails from thermal expansion. Standard aluminum in cold climates fails energy code. Steel in budget projects wastes money.

Decision Matrix by Building Type

| Building Type | Recommended Material | Why This Choice | يتجنب | نطاق التكلفة |

|---|---|---|---|---|

| Mid-rise residential (3-12 floors) | Vinyl (high-performance) or Aluminum (thermal break) | Vinyl: lowest lifecycle cost, good thermal (U-0.28-0.35) Aluminum: longer lifespan (40 vs 30 yr), lower maintenance | Steel (over-engineered, 2× cost without resident benefit) | $550-930 |

| High-rise commercial (12+ floors) | Aluminum (thermal break) | Wind load capability ±40-60 PSF, 40-50 year lifespan matches building life, minimal thermal expansion at height | Vinyl (thermal expansion >12 floors causes seal failure) | $780-1,150 |

| Ground-floor storefront | Aluminum (standard or thermal break) | Large glass area support (50-150 sq ft), narrow sightlines (aesthetic), high traffic durability | Vinyl (lacks structural capacity for large spans) | $80-120/sq ft |

| Coastal hurricane zones | Aluminum or Vinyl (impact-rated) | Miami-Dade NOA or TBCE certification available, aluminum offers better longevity in salt air with proper coating | Non-certified (insurance void, occupancy denial) | $1,000-1,560 |

| Historic/signature buildings | Steel or Bronze (architectural) | Narrow sightlines preserve historic character, 50-60 year lifespan, custom profiles match original design | Vinyl (not allowed in historic districts per preservation codes) | $1,260-2,200 |

| Institutional (schools, hospitals) | Aluminum (thermal break) | 40-50 year lifespan matches building design life, low maintenance (critical for budget-constrained facilities), security glazing compatible | Vinyl (25-30 year lifespan requires premature replacement) | $780-1,150 |

Special Considerations for Storefront Windows

Storefront windows (ground-floor retail/commercial glass facades) have unique requirements that affect material selection and cost:

Key differences from typical commercial windows:

- Larger glass area: 50-150 sq ft per unit vs 15-30 sq ft typical

- Structural requirements: Must support own weight plus wind load (no intermediate framing)

- Aesthetic priority: Narrow sightlines (1-2″ frame width) for maximum glass visibility

- Impact risk: Pedestrian traffic, vehicle contact, vandalism → tempered or laminated glass required

- Thermal bridging: Large aluminum frames conduct heat unless thermally broken

Cost structure: $80-120 per square foot installed (vs $50-90 typical commercial)

Material recommendation: Aluminum with thermal break. Vinyl lacks structural capacity for large spans. Steel works but costs 40-60% more without functional benefit for most retail applications.

💡 Manufacturer Insight:

We’ve manufactured storefront systems for multiple retail projects. The most common mistake: developers spec standard aluminum (non-thermal break) to save 15-20%, then fail energy code inspection in cold climates. Miami and Phoenix allow non-thermal storefront, but Chicago, Denver, and anywhere above Zone 4 require thermal break for code compliance. Verify with local jurisdiction before ordering—remanufacturing costs $15-30K on typical 500 sq ft storefront.

When to Replace vs Repair Commercial Windows

The first decision in any commercial window project: Does the building need full replacement, or can targeted repairs extend window life 5-10 years?

Financial breakpoint: When repair costs exceed 50% of replacement cost, replacement delivers better ROI through:

- Warranty coverage (10-20 years on new windows vs no warranty on repairs)

- Energy efficiency gains (older windows lose 25-40% more heat than current code-minimum)

- Reduced maintenance (new windows eliminate ongoing repair cycles)

Repair vs Replace Decision Matrix

| Window Condition | Typical Repair Cost | Replacement Cost | توصية | Rationale |

|---|---|---|---|---|

| Single broken seal (condensation between panes) | $80-150/window | $450-720/window | Repair if <10 years old | Isolated failure, frame still viable |

| Multiple seal failures (20%+ of windows) | $100-180/window | $450-720/window | Replace | Labor cost makes repair uneconomical at scale |

| Frame corrosion (aluminum) | $150-300/window patch | $630-950/window | Replace | Structural integrity compromised, liability risk |

| Failed thermal performance (condensation, ice dams) | Not repairable | $780-1,280/window | Replace | No repair option, energy code violation if upgrading |

| Operational failure (won’t open/close) | $120-250/window | $450-720/window | Repair if <15 years old | Hardware replacement feasible on newer windows |

| Aesthetic obsolescence | غير متوفر | $450-1,800/window | Replace (if ROI exists) | Branding/repositioning ROI for commercial properties |

Age-based guidelines:

- Vinyl windows >25 years: Replace (end of expected lifespan, frame brittleness)

- Aluminum windows >35 years: Replace (sealants degraded, thermal performance lost)

- Steel windows >50 years: Case-by-case (frame may be viable, reglazing option)

ROI Analysis: Energy Savings from Replacement

Example scenario: 180-window office building, Chicago (Zone 5), existing windows 30 years old (U-factor ~0.65), replacement with thermal break aluminum (U-factor 0.32).

Annual energy savings typically fall in the $2,500–4,000 range, depending on HVAC efficiency and operating hours.

Replacement cost: $850/window × 180 = $153,000

Simple payback from energy savings alone: Long-term (20+ years). But when including:

- Avoided maintenance (estimated $800-1,200/year on 30-year-old windows)

- Property value increase (8-12% higher lease rates with energy-efficient envelope)

- Operational improvements (reduced HVAC runtime)

Effective payback: 18-25 years, within building ownership horizon for most institutional/commercial owners.

When energy ROI doesn’t justify replacement: Mild climates (Zones 1-2), buildings with <10 year ownership horizon, windows <20 years old with adequate thermal performance (U-factor <0.45).

How to Evaluate Commercial Window Suppliers

60% of commercial window project failures stem from supplier issues—not product design, but execution problems: missed specifications, inadequate testing, poor quality control, insufficient engineering support.

This 10-point checklist identifies reliable suppliers and red flags that predict costly problems:

Supplier Evaluation Checklist

| معايير | What to Verify | Red Flags | معيار هوتيان |

|---|---|---|---|

| 1. Certification Validity | NFRC label license number, AAMA certification current (not expired) | “Certification pending” or no certificate number provided | Designed to meet NFRC/AAMA/CE standards |

| 2. Test Reports | Independent lab testing (IAS-accredited), not manufacturer self-test | Only in-house test data, or no test reports offered | ASTM E283/E331/E330 from IAS labs, available on request |

| 3. Wind Load Verification | Specific tested rating (not “up to ±60 PSF”—must match your requirement) | Generic claims without test documentation | Test reports for specific ±30/±45/±60 PSF ratings |

| 4. Impact Certification | Miami-Dade NOA number (for HVHZ), TAS 201-203 (Texas coast) | “Hurricane-resistant” without certification number | Support for coastal projects as required |

| 5. Material Warranty | 10+ years frame/sash, 20+ years insulated glass seal | <5 years, or “limited warranty” with many exclusions | 10-year material defects, 20-year seal warranty |

| 6. MOQ Flexibility | Accepts your project size, reasonable minimums | “1000-unit minimum” too rigid for mid-size projects | 100+ windows for commercial projects, batch orders welcome |

| 7. Lead Time Realism | 10-14 weeks typical (standard specs), 14-18 weeks (custom) | “4-6 weeks” (red flag: cutting corners or overpromising) | 10-14 weeks includes proper QC, testing, crating |

| 8. Engineering Support | Provides submittal packages: CAD, specs, calculations, test reports | “You handle submittals” or charges $2-5K extra | Full submittal package included, engineer review available |

| 9. Project Experience | References from similar building types, climates, project scales | Only residential experience, no commercial portfolio | Multiple commercial projects, references available |

| 10. Payment Terms | 30-50% deposit, balance on shipment/delivery | 100% upfront (high risk of non-delivery or quality issues) | 30% deposit, 70% on shipment, standard international terms |

Performance Specifications & Code Compliance

Commercial window specifications must balance three requirements: building code minimums (non-negotiable), energy code efficiency targets (affect operating cost), and project-specific performance needs (acoustics, security, blast resistance).

Thermal Performance by Climate Zone

U-factor (heat loss) و SHGC (solar heat gain coefficient) are the two specifications that determine energy code compliance and operational cost.

| المنطقة المناخية | Example Cities | Code Min U-Factor | Recommended U-Factor | SHGC Target | لماذا |

|---|---|---|---|---|---|

| Zone 1-2 (Hot) | Miami, Phoenix, Houston | 0.75-0.90 | 0.40-0.50 | 0.23-0.28 | Cooling-dominated, solar control priority |

| Zone 3-4 (Mixed) | Atlanta, San Francisco, Dallas | 0.50-0.65 | 0.35-0.40 | 0.30-0.40 | Balance heating/cooling |

| Zone 5 (Cold) | Chicago, Denver, Boston | 0.35-0.40 | 0.28-0.35 | 0.35-0.45 | Heating-dominated, capture solar gain |

| Zone 6-8 (Very Cold) | Minneapolis, Duluth, Alaska | 0.30-0.35 | 0.22-0.28 | 0.40-0.50 | Extreme heating, maximize insulation |

Energy code reference: Most jurisdictions adopt ASHRAE 90.1 or IECC (International Energy Conservation Code). Both specify maximum U-factor and SHGC by climate zone. Verify local amendments—some cities (California, Seattle, NYC) have stricter requirements than base codes.

Material capability:

- فينيل: U-factor 0.25-0.35 (good for cold climates)

- Aluminum standard: U-factor 0.50-0.70 (poor, only suitable for mild climates)

- Aluminum thermal break: U-factor 0.30-0.42 (meets most codes)

- Steel thermal break: U-factor 0.35-0.50 (moderate)

- الألياف الزجاجية: U-factor 0.20-0.30 (best, but higher cost)

Structural Performance: Wind Load & Water Resistance

Three ASTM test standards govern commercial window structural performance:

ASTM E283 (Air Leakage):

- Measures cubic feet per minute (CFM) of air infiltration at 1.57 PSF pressure

- Commercial requirement: ≤0.30 CFM/sq ft (AAMA standard)

- Lower is better (less air leakage = better thermal performance, less dust infiltration)

ASTM E331 (Water Penetration):

- Tests window assembly under simulated wind-driven rain

- Commercial requirement: No water penetration at pressure equivalent to 20% of design wind pressure

- Example: ±45 PSF wind-rated window must resist water at 9 PSF (equivalent to 77 mph winds + rain)

ASTM E330 (Structural Wind Load):

- Tests window resistance to positive (inward) and negative (outward/suction) wind pressure

- متطلبات: Must withstand 1.5× design pressure without permanent deformation, 3× without glass breakage

- Example: Building in 130 mph wind zone requires windows rated ±50 PSF (tested to ±75 PSF without damage)

Why these numbers matter: Passing mockup testing. Most commercial projects require full-scale mockup testing before window installation begins. If your specified windows fail any of these three tests, the entire order may need to be remanufactured—costing $80-200K and delaying schedule 10-16 weeks.

Mockup testing costs: $8,000-18,000 depending on test scope (some projects only require E283/E331, critical projects add E330 structural). Building owner typically pays, but failing mockup due to inadequate specification becomes contractor’s liability.

Acoustic Performance (Multi-Family & Urban Projects)

For residential and mixed-use buildings, acoustic isolation is critical for tenant satisfaction and lease renewals.

STC (Sound Transmission Class) requirements:

- Code minimum (IBC): STC 32 (party walls between units)

- Market-rate residential: STC 35-38 (competitive expectation)

- Luxury residential: STC 40-45 (premium positioning)

- Urban high-noise locations: STC 45-50 (airports, highways, entertainment districts)

How to achieve acoustic performance:

- Standard dual-pane windows: STC 28-32

- Dual-pane with laminated glass: STC 35-38

- Dissimilar glass thickness (5mm + 8mm): STC 38-42

- Triple-pane with laminated: STC 42-48

Cost impact: Each STC tier adds approximately 15-25% to window cost (laminated glass adds $8-15/sq ft, triple-pane adds $25-40/sq ft).

Installation Cost Variables & Project Timeline

Installation labor represents 30-40% of total window replacement cost. These factors drive variation:

عوامل تكلفة التثبيت

| عامل | Low-Cost Scenario | High-Cost Scenario | تأثير التكلفة |

|---|---|---|---|

| Building access | Exterior access (scaffolding or lift), ground-level | Interior-only access, 15+ floors, working elevator required | 2-3× labor cost |

| Opening condition | Clean openings, existing windows easily removable, minimal prep | Masonry removal required, non-standard openings, extensive flashing rework | +40-80% |

| Installation season | Spring/fall (moderate weather), flexible schedule | Winter (cold weather protocols), summer heat, or tight deadline | +20-40% |

| Building occupancy | Vacant building, full access, no tenant coordination | Occupied building, restricted hours (after-hours/weekend work) | +35-60% |

| Waterproofing complexity | Standard flashing, routine weather barrier integration | Complex air barrier systems, consultant oversight, extensive mockup | +30-50% |

Installation labor rate range: $65-150 per window depending on above factors

Typical project (100 windows, 8-story building, moderate complexity): $85-110 per window labor = $8,500-11,000 total installation labor

Project Timeline: Order to Completion

Realistic timeline for commercial window replacement (150-window project, standard specifications):

| Phase | Duration | Key Activities | Delays to Avoid |

|---|---|---|---|

| Specification & Bidding | 2-4 weeks | Finalize specs, request quotes, evaluate suppliers, select | Incomplete specs lead to change orders later |

| Engineering & Submittals | 3-4 weeks | Supplier provides submittal package, architect reviews, approval | Missing test reports delay approval |

| تصنيع | 10-14 weeks | Production, quality control, testing, crating | Custom specs add 4-6 weeks if not communicated early |

| Shipping | 1-3 weeks | Domestic freight or international ocean/air | Container shortages can add 2-4 weeks (order early) |

| تثبيت | 3-5 weeks | Site prep, window installation, flashing, interior trim | Weather delays in winter, schedule buffers needed |

| Inspection & Closeout | 1-2 weeks | Building inspector approval, punch list, warranty documentation | Failed inspection if specs don’t match permit |

Total project duration: 20-32 weeks (5-8 months) from specification to completion.

Critical path items:

- Manufacturing lead time (10-14 weeks) is longest single phase—order windows before other building work is complete if possible

- Engineering submittals must be approved before manufacturing starts (otherwise 3-4 week delay)

- Schedule installation during favorable weather (spring/fall ideal, avoid winter in cold climates or summer in extreme heat)

💡 Manufacturer Insight:

The scheduling mistake that adds the most cost: ordering windows to arrive exactly when building is “ready” for installation. Reality: building work always runs 2-4 weeks behind schedule. If windows arrive before building is ready, they need storage (damage risk, theft risk, storage fees $800-1,500/month). If windows are ordered late to avoid storage, you add 2-4 weeks to critical path. Optimal approach: Order windows with 2-week buffer after estimated building ready date. Store on-site in weather-protected area (can be temporary—plywood enclosure with tarp cover costs $600-1,200 vs storage fees). This keeps project on schedule while protecting windows until installation.

7 Costly Commercial Window Replacement Mistakes

These seven errors account for the majority of project failures and cost overruns we see across commercial projects:

❌ Mistake #1: Accepting “Or Equivalent” Substitutions Without Verification

What happens: Architect specifies “Brand X windows, ±50 PSF, U-factor 0.35, or equivalent.” Contractor substitutes cheaper windows claiming “equivalent” to save 10-15%. At mockup testing, substitute windows fail (actually rated ±40 PSF or U-factor 0.42).

Cost impact: $80-150K to reorder correct windows + 8-12 week schedule delay + potential GC liability for mockup failure costs.

How to avoid: Require contractors to submit test reports proving equivalent performance قبل issuing purchase order. “Equivalent” must mean equivalent in every specification—not just similar.

❌ Mistake #2: Choosing Vinyl for Buildings >12 Stories

What happens: Developer specs vinyl windows for 15-story building to save 20-30% vs aluminum. Thermal expansion at height causes frame warping (vinyl expands 3-5× more than aluminum per °F). Result: Seal failures within 3-5 years, water intrusion, need for early replacement.

Cost impact: $120-200K premature replacement at year 5-8 (vs 30+ year expected life).

How to avoid: Use vinyl only for buildings ≤12 stories. Above that height, thermal expansion becomes too great. Specify aluminum with thermal break for high-rise projects regardless of initial cost premium.

❌ Mistake #3: Skipping Mockup Testing on Large Projects

What happens: To save $10-15K mockup cost, developer proceeds directly to installation based on manufacturer’s generic test reports. Discovers at building inspector final review that windows don’t meet local energy code (jurisdiction has stricter-than-ASHRAE requirements).

Cost impact: Cannot obtain certificate of occupancy until windows are replaced. Holding cost on $20M building at $25K/month + window replacement $150-300K.

How to avoid: Budget for mockup testing on any project >$200K window value or with stringent performance requirements (LEED, historic, coastal). Mockup cost is insurance against catastrophic failure.

❌ Mistake #4: Over-Specifying Performance (Paying for Unneeded Capability)

What happens: Architect specifies impact-rated windows (ميامي ديد NOA) for inland building 80 miles from coast, doubling window cost unnecessarily. Or specifies triple-glazed U-factor 0.22 windows in Phoenix (cooling-dominated climate where solar control matters more than insulation).

Cost impact: $40-80K wasted on over-specification that provides no functional or code benefit.

❌ Mistake #5: Ignoring Shipping & Logistics Costs for Overseas Sourcing

What happens: Developer orders windows from overseas manufacturer at 30% lower unit price, but doesn’t account for $40-60/window shipping cost, $8-15/window customs/duty, $5-10/window crating, $2-4/window inspection fees. Actual landed cost is only 8-12% savings, and extended lead time (16-20 weeks vs 12 weeks domestic) delays project.

Cost impact: Schedule delay costs $15-30K in construction loan interest, plus minimal savings vs domestic sourcing.

How to avoid: Always calculate landed cost (FOB factory price + shipping + duties + crating + inspection + storage) when comparing suppliers. For projects <300 windows, domestic sourcing often has better total cost despite higher unit price. For projects >300 windows, overseas factory-direct can save 20-30% at landed cost if properly planned.

❌ Mistake #6: Not Verifying Lead Time with Current Market Conditions

What happens: Supplier quotes “10-12 week lead time” based on historical averages. But current aluminum supply shortage extends actual lead time to 18-22 weeks. Project timeline assumes 12 weeks, resulting in 8-week delay.

Cost impact: $25-50K construction loan interest + cascade delays to other trades + potential liquidated damages.

How to avoid: When requesting quotes, ask: “What is your current lead time as of [today’s date] for [project size]?” Get lead time guarantee in writing or at minimum a commitment to notify immediately if lead time extends beyond quoted range.

❌ Mistake #7: Choosing Supplier Based Solely on Lowest Price

What happens: Three qualified bids at $750-820/window. One outlier bid at $580/window. Developer selects low bid. Supplier cuts corners: uses non-certified glass (fails NFRC requirement), skips proper thermal break (fails energy code), provides no engineering support (architect must hire consultant for $8K to prepare submittals).

Cost impact: Failed building inspection + $60-90K to re-source compliant windows + $8K engineering fees + 12-week delay = total loss $90-150K to save $24K initial cost.

How to avoid: Eliminate bids >25% below median. Extreme low bids signal either misunderstanding of specifications or intentional corner-cutting. Verify all certifications before accepting any bid, even if not lowest price.

Regional Codes & Global Standards Quick Reference

This guide focuses on North American standards (NFRC, AAMA, ASHRAE 90.1, IBC), which represent a significant portion of Hotian’s commercial window projects. For international projects, key standards differ:

Regional Standards Comparison

| منطقة | Thermal Standard | Wind/Water Standard | Required Certification | Key Differences from US |

|---|---|---|---|---|

| أمريكا الشمالية | U-factor <0.40 (BTU/hr·ft²·°F) ASHRAE 90.1 | Design Pressure (PSF) ASTM E283/E331/E330 | NFRC, AAMA, ENERGY STAR | Baseline global reference |

| Europe (EU) | Uw <1.4 W/m²·K EN 14351-1 | Wind class 1-5 (EN 12211) Water class 1-9 (EN 12208) | CE marking (mandatory) | Different units (W/m²·K), stricter thermal |

| United Kingdom | U-value <1.6 W/m²·K Part L (Building Regs) | Wind exposure A-D BS 6375 | BFRC rating, Document Q (security) | Post-Brexit separate from EU, security focus |

| أستراليا | U-value 4.0-6.0 W/m²·K NCC (National Construction Code) | SWP (Structural Wind Pressure) BAL (Bushfire Attack Level) | WERS rating, AS 2047 | Bushfire zones strict, cyclone areas |

| Middle East | No specific (LEED common) Extreme heat focus | High wind + sand ingress | LEED, Estidama (Abu Dhabi) | Solar control (SHGC <0.25) critical |

Note on units: US uses U-factor (BTU/hr·ft²·°F) where lower = better insulation. Most other regions use Uw or U-value (W/m²·K). To convert: multiply US U-factor × 5.68 = W/m²·K. Example: US U-factor 0.30 ≈ Uw 1.70 W/m²·K.

Hotian global certifications: NFRC (North America), CE marking (Europe), AAMA Gold Label (structural/thermal), ENERGY STAR partner. For projects requiring region-specific testing, we work with local accredited labs to obtain necessary certifications within 8-12 weeks.

Why Factory-Direct Sourcing for Commercial Window Replacement

Traditional commercial window supply chain involves 3-4 markup layers:

- Manufacturer wholesale price (baseline)

- Distributor markup: +40-60%

- Dealer markup: +20-30%

- Contractor markup: +10-15%

نتيجة: Final price is 180-230% of manufacturer wholesale cost.

Factory-direct model eliminates steps 2-3, reducing total cost 25-35% while maintaining identical product quality and certifications. However, factory-direct requires the supplier to provide services traditionally handled by distributors:

What Factory-Direct Suppliers Must Provide

| Service | Traditional Distributor Role | Factory-Direct Requirement |

|---|---|---|

| Engineering support | Submittal prep, CAD drawings, specs | Manufacturer must provide in-house |

| Project management | Order tracking, schedule coordination | Manufacturer assigns dedicated PM |

| Local inventory | Stock common sizes, 2-day lead time | Not possible—factory ships direct, 10-14 week lead |

| After-sales service | Handle warranty claims, replacement parts | Manufacturer handles direct (may be overseas) |

| الخدمات اللوجستية | Domestic trucking, receive/inspect | International shipping, customs (if overseas manufacturer) |

When factory-direct makes sense:

- ✅ Projects >150 windows (volume justifies direct relationship)

- ✅ Standard specifications (custom orders don’t benefit from distributor stock)

- ✅ Timeline allows 12-16 weeks (includes ocean shipping if overseas)

- ✅ Buyer has capability to handle logistics (receiving, storage, coordination)

When distributor adds value:

- Small projects <100 windows (distributor stock avoids minimum order quantities)

- Rush timeline <8 weeks (distributor may have inventory)

- Highly custom specifications (distributor can aggregate multiple manufacturers)

- Buyer lacks logistics capability (distributor handles receiving/storage)[debesto]

Hotian’s Factory-Direct Advantage for Commercial Projects

Manufacturing capability: 15+ years producing commercial windows for North American, European, and other markets. Production capacity supports projects from 100 to 5,000+ windows.

Certifications & testing: Products designed to meet NFRC, AAMA and CE standards, with full test reports available from accredited labs. We provide comprehensive engineering support including submittal packages, CAD drawings, and structural calculations at no additional cost for qualifying commercial projects.

Global logistics: Experienced with FOB/CIF terms, full container loads (20-24 windows per 20′ container), and customs documentation for major markets. Typical landed cost savings: 20-30% vs distributor pricing on projects over 150 windows.

Ready to discuss your commercial window replacement project? Contact our project team for a free cost analysis and specification review tailored to your building type, location, and performance requirements.